Our investment in BAT

Dear investors,

In the letter from June 2024, we explain why we decided to start investing outside of Brazil. We had previously invested in two British companies, one of which was British American Tobacco (BAT). We recently sold that position for a return of ~31% in pounds sterling (~49% in reais) in just under a year.

It was a small investment, part of the proof of concept that it would be possible to apply our investment philosophy in other geographies with similar success to what we have in the Brazilian stock market. With the always unfair perspective of hindsight, we should have invested more.

Whether for its value as a proof of concept or for how interesting it was to study the tobacco industry, which is full of controversies and has evolved in a very atypical way in recent decades, we thought it would be worth sharing the story of this investment thesis with you.

A Brief History of the Tobacco Industry

Tobacco is native to the Americas and was brought to Europe in the 15th century by Christopher Columbus. In the following centuries, it became popular and became one of the most valuable commodities in global trade, rivaling sugar and cotton. Until the end of the 19th century, tobacco products were artisanal: pipe tobacco, cigars, and snuff. The Industrial Revolution enabled the mass production of the cigarettes we know today, and British American Tobacco, founded in 1902, was one of the first tobacco companies to achieve global reach.

Tobacco consumption peaked in the 1960s, when evidence began to emerge that there was a correlation between smoking and lung cancer. At the time, the tobacco industry responded by denying that its products caused any adverse effects and publicly combating its accusers. Later, internal documents from major companies were discovered revealing that they were not only aware of the health risks but were also studying ways to make cigarettes deliver more nicotine, which increased smokers' addiction. The tobacco industry's lack of ethics during this period generated a strong reaction from regulators and created a reputational stain that endures to this day.

From the 1970s onward, anti-smoking public policies were implemented around the world. One of the first measures was to ban cigarette advertising. This made it virtually impossible for new companies to enter the industry. How can you launch a widely consumed product or expand your market share without advertising? This move ultimately benefited large tobacco companies, which drastically reduced their advertising expenditures while maintaining their sales volumes virtually unchanged. Limited growth and the stigma surrounding the industry led to a massive consolidation movement, and today the world's five largest tobacco companies account for 93% of global sales.

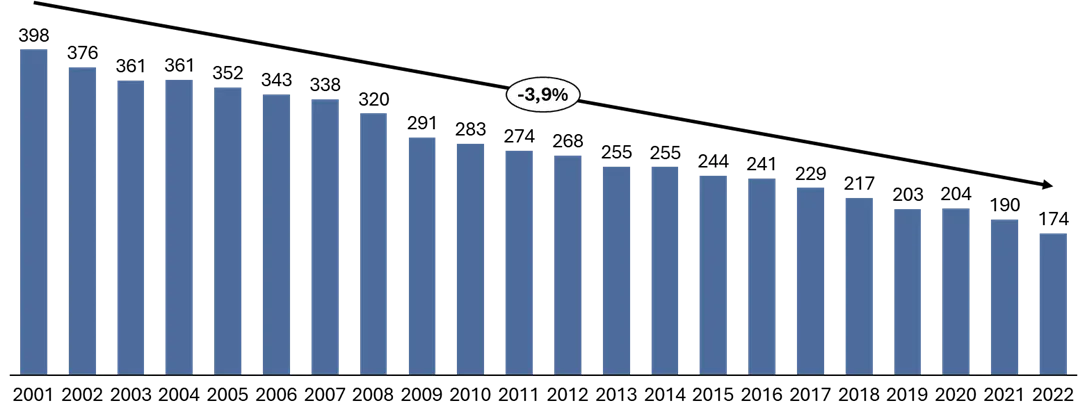

Over 50 years of anti-smoking campaigns have been effective from a public health perspective. Today, only 10-151% of the population in developed countries consumes tobacco products, compared to over 40% in the 1960s. As a result, sales volumes have been declining, and the traditional cigarette business is doomed to disappear or become a small niche market.

Cigarette sales volume in the United States (billions of units)

Source: Federal Trade Commission – Cigarettes Report

New generation of tobacco products

The tobacco industry's evolution has focused on seeking new products that maintain the benefits consumers enjoy while reducing, or ideally, eliminating, the health risks. The result of this effort has been three new product classes: electronic cigarettes (vapes), heated tobacco, and nicotine pouches. Collectively, they are called NGP (New Generation Products). The general concept is to deliver nicotine, which produces the effect smokers enjoy, without emitting the carcinogenic byproducts of tobacco burning. There is still widespread debate about the extent to which these new products are harmful to health. The prevailing opinion is that they are less harmful than traditional cigarettes, but that nicotine itself is unhealthy to consume, so their consumption remains discouraged.

Interestingly, regulators have been more restrictive toward new products, especially vapes, than toward cigarettes themselves. The apparent motivation is the view that cigarette smokers are already addicted to the product and cannot be prevented from using it. If cigarettes were banned, this consumption would be shifted to the black market and would continue to exist illegally. However, regulators are ambitious about preventing young people from becoming new smokers and have taken action against vapes in an attempt to curb the growth of this market.

Regulation varies significantly from country to country. In the United States, the sale of vapes is permitted, but flavors are restricted to tobacco and menthol, under the argument that other flavors (e.g., fruit and candy) are more appealing to young people. In Brazil, the sale of vapes is completely prohibited. However, in both markets, the bans have not been successful in curbing use. In the United States, 60-70% of vapes consumed are illegal products. In Brazil, 100% is contraband. In both countries, illegal vapes are readily available. They can be purchased locally and even online.

The biggest problem with smuggling is the complete lack of control over what's being sold. While legal vapes comply with regulatory requirements (in the US, the FDA), illegal products don't follow any standards. There are cases of heavy metal contamination and nicotine concentrations much higher than stated on the packaging of illegal products. The dilemma is: continue trying to combat vapes and prevent smuggling, or reduce restrictions to shift consumption to legal products, where there is greater quality control? So far, the illegal market has only grown.

The possible future of NGPs

An undeniable fact is that people like nicotine. Before the harmful effects of cigarettes became common knowledge, practically half the population smoked. In underdeveloped countries, the smoking rate is still close to that. It's very likely that cigarette consumption will never return to what it once was, for good reason: smoking over decades reduces life expectancy by between 5 and 15 years (depending on the volume of daily consumption). But the discussion that NGPs now bring is: what are the harmful effects of consuming pure nicotine, through routes not associated with burning tobacco?

There's still little research separating nicotine consumption from traditional cigarettes, but there's evidence that the health risks of pure nicotine are much lower than those associated with burning tobacco. A study published in Public Health England (the UK's health agency) states that vaping is 95% less harmful than cigarettes. If this assessment becomes a consensus in academia, would it make sense to continue investing in anti-vaping campaigns?

The discussion is sensitive, but it's clear that people often don't follow best practices for maintaining good health. For example, consuming alcoholic beverages is known to be harmful, but widely accepted in most countries. Even more common is the consumption of foods high in fat and sugar. Even though they are fully aware of the harmful effects these products cause, most people don't want the government monitoring their personal habits and imposing restrictions in the name of public health. The appropriateness of regulatory intervention will always be the result of a discussion that encompasses cultural factors, the degree of harm discussed, and the question of whether or not third parties are harmed by the activity. In the case of cigarettes, the considerable harm and the health impact on non-smokers exposed to cigarette smoke (known as passive smokers) were the main arguments for regulatory action. In NGPs, this logic will not necessarily hold.

Today, there is strong regulatory action against NGPs, especially vaping, in several countries. We believe the main driver is the association with traditional cigarettes and distrust of big tobacco companies. However, we believe that what will define the final state of the NGP industry will be scientific evidence and popular opinion about the habit, not the regulator's original intention. One case that reinforces this view is the history of Prohibition in the United States.

In 1920, the production and sale of alcoholic beverages was banned throughout the United States. The motivation wasn't health-related, but rather the argument that excessive alcohol consumption caused social problems, domestic violence, and crime. Initially, alcohol consumption declined, but the black market quickly developed, and organized crime dominated the production and sale of alcoholic beverages. After 13 years, the U.S. government admitted the law's failure and repealed it.

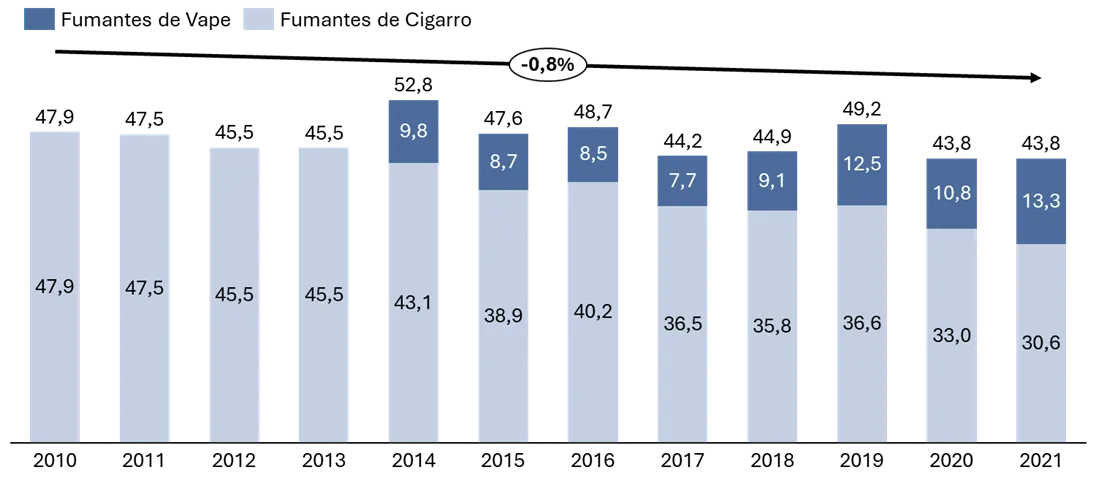

What we wonder is whether the history of vaping isn't an echo of Prohibition. As with alcohol, regulatory pressure hasn't been enough to curb nicotine consumption. The number of cigarette smokers has been declining, but new vape smokers are offsetting the decline, and the total number of nicotine users has remained virtually stable.

Number of cigarette and vape smokers in the United States (millions)

Source: US. Census, lung.org statistics

If anti-vaping regulations are repealed in the future, the growth potential for NGPs in the market is likely to reach the level of cigarette consumption in the 1960s, when over 40% of the population smoked. In this scenario, big tobacco companies could expand rapidly, as they currently have the products and distribution channels to dominate this market.

Why do we buy BAT?

BAT is the world's largest tobacco company, with ~30% of the global traditional tobacco market (cigarettes, cigars, and snuff) and a similar share of the legal NGP market. The company operates in 180 countries with well-known traditional tobacco brands (e.g., Lucky Strike, Dunhill, Pall Mall, Kent, Camel) and in over 60 countries with major NGP brands (Vuse, Glo, and Velo). It has annual revenues of GBP 26 billion, an EBITDA margin of ~45% (~GBP 12 billion), generates substantial cash (~GBP 8 billion), and pays a generous dividend (~GBP 5 billion).

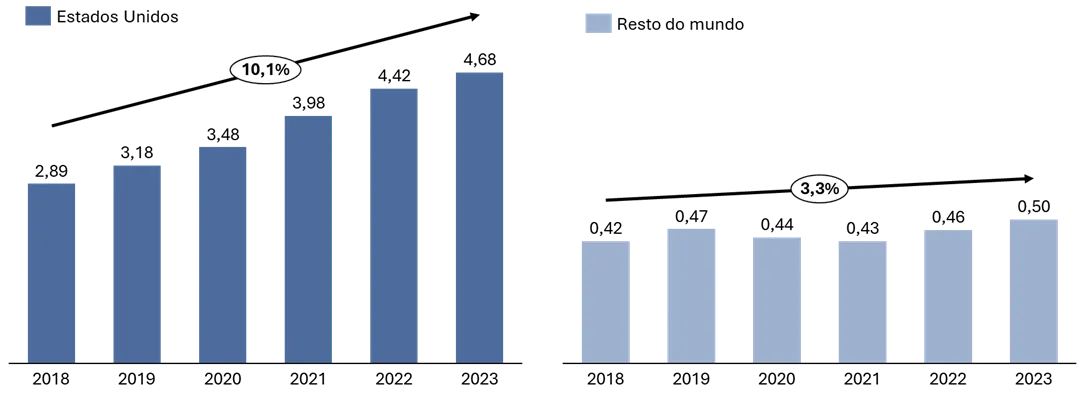

The financial results are excellent, but the future of the business is unclear. Within the company, there are two product segments with very different dynamics. Traditional products, primarily cigarettes, currently represent ~87% of revenue but are in clear decline. New-generation products, primarily vapes, account for the remaining 13% and have significant growth potential based on public acceptance, but strong regulatory resistance prevents this growth from materializing. Each segment had to be analyzed separately.

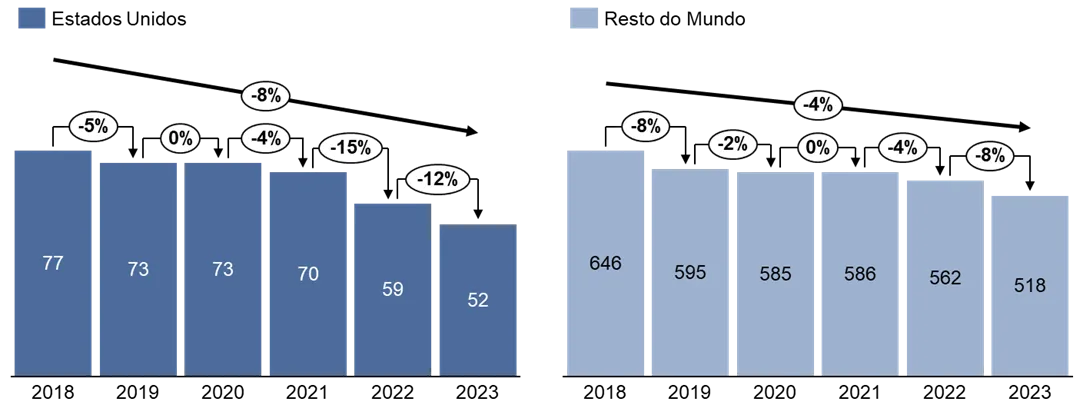

The history of cigarette consumption confirms what we already know from direct observation: few smokers quit. What has caused the smoking population to decline is that the number of new smokers is increasingly smaller. In other words, sales volume declines as the smoking population ages, dies, and is not replaced by new generations of equally numerous smokers. This demographic dynamic is inevitable, but slow. As a result, the rate of decline in cigarette consumption has followed a more or less predictable trajectory.

Number of cigarettes sold by geography (billions of units)

Source: BAT

Interestingly, BAT's revenue and EBITDA from cigarette sales have remained unchanged despite the decline in volume, thanks to a very simple strategy: raising cigarette prices to offset the decline in volume. It's counterintuitive that this would work, but smokers have proven to be relatively price-sensitive, and large tobacco companies have been applying annual price adjustments above inflation for several years. The effect has been to increasingly increase the profitability of the tobacco industry, which would attract new competitors under normal circumstances, but regulatory restrictions prevent this from happening.

Average price per pack of BAT cigarettes (USD per unit)

Source: BAT

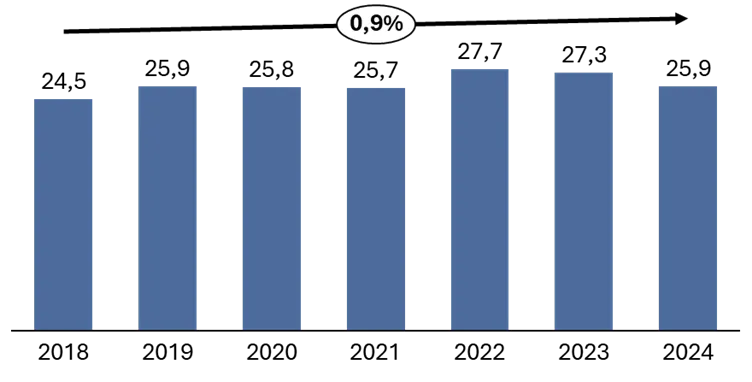

BAT Net Revenue (GBP billion)

Source: BAT

The issue of vapes is more delicate, largely because it depends on regulatory stance. Even if the ultimate scenario is the lifting of restrictions, as was the case with the Dry Law, the time needed for this to happen could follow historical example and exceed a decade. Assuming liberalization occurs, there is still uncertainty about the profitability level of this new product segment, as in a more relaxed regulatory environment, new competitors and potential price wars may emerge. The possible scenarios are so varied that the conclusion is unclear: the NGP segment could be worth very little or more than the entire BAT is worth today. Fortunately, at the time we decided to buy shares, it was not necessary to have a more precise view of this segment.

We included BAT shares in our portfolio in April 2024. The company's value on the London Stock Exchange was ~GBP 52 billion, and our estimates indicated that, even with traditional cigarette revenue declining rapidly and NGP revenue stagnating forever, the likely return was around 10% per year in British pounds, a currency with a historical inflation rate of 1-3% per year. Nothing phenomenal, but quite satisfactory for a somewhat pessimistic scenario. The stock was clearly mispriced. At this price, we took for free the options that cigarette sales would decline more slowly and the NGP segment would grow. Not having to pay for the unpredictable part of the business made the purchase decision much easier.

Why do we sell BAT?

A year after becoming a BAT shareholder, the landscape hasn't changed much compared to what we saw at the time of our purchase. Traditional cigarettes continue to decline in key markets, while NGPs continue to see their growth hampered by regulatory barriers, and illegal products continue to meet the majority of demand. Regulatory developments around the world have been extremely slow and are still moving toward being more restrictive for vaping, not less so.

During this period, the stock price rose to a level we considered more reasonable, and the logic that we were taking the existing option in the vape business for free no longer holds true. Meanwhile, several Brazilian stocks remain significantly discounted, and we have virtually all of our funds allocated. So why not sell BAT to buy more shares in companies with higher return potential? We did.