Chips: the brain of the digital economy

Dear investors,

In April 1965, an article titled "Cramming More Components Onto Electronic Circuits" appeared in Electronics Magazine. This publication, whose title could be grasped in its full magnitude only by engineering enthusiasts, became one of the most influential contributions in history.

The article was written by Gordon Moore, an electronics engineer and then director of R&D at Fairchild Semiconductor, one of the future founders of Intel. In his article, Moore predicted that the number of transistors on an integrated circuit would double on average every two years. This prediction eventually became known as Moore's Law.

The prediction was originally made for the next 10 years, but it still holds true today, almost 60 years later. It's thanks to this prediction that the number of transistors that fit on a chip has increased from 4 billion to over 16 billion today¹, enabling this technology to become increasingly prevalent in our lives. At the center of the digital universe, chips, or microprocessors, are the brains behind computers, smartphones, tablets, and a myriad of electronic devices that form the basis of the digital economy. Without them, many of the advances we see in fields such as artificial intelligence, Big Data, the Internet of Things (IoT), and cloud computing, for example, would not be possible.

Demand for chips is growing across a variety of sectors, from automotive to healthcare, agriculture, and even space exploration. Chip shortages can have dramatic effects on production and the economy as a whole, an effect that became evident during the pandemic, when the chip shortage significantly impacted the automotive industry. A modern vehicle has, on average, 1,500 chips. Without them, many vehicles have ceased production, which is estimated to have caused the industry to lose up to ~USD 200 billion in sales in recent years. This impact is equally notable in the sharp rise in car prices we witnessed during the same period.

Considering that the technology in this industry is held by very few companies, each specializing in a different stage of the production chain, new bottlenecks are not unthinkable and could be much more severe than those faced during the pandemic – especially considering that the company responsible for producing almost 90% of the world's most advanced chips² (TSMC) is located in Taiwan.

In the following paragraphs, we briefly explain the history of the industry, its current configuration, its role in the global geopolitical landscape, and its implications for our investments. For those interested in delving deeper into the subject, we recommend reading the book Chip War, by Chris Miller.

What exactly is a chip

To understand how a chip works, it's helpful to start with the concept of a semiconductor.

Semiconductors are materials with electrical properties that fall between those of conductors (such as copper, which conducts electricity very well) and insulators (such as rubber, which does not conduct electricity). Silicon is the most commonly used semiconductor in chip manufacturing—it is from this element that the US region called Silicon Valley is named.

In chips, tiny components called transistors are created from this semiconductor. Think of the transistor as a tiny switch that can turn electricity on and off. This ability to control electricity is crucial to the chip's operation, as it is how binary language (a code of 1s and 0s) is represented. When the transistor is "on," it registers a "1," and when it is "off," it registers a "0." This series of 1s and 0s is the fundamental language computers use to process information.

Brief history of the chip industry

The semiconductor industry has its roots in the 20th century, when the invention of the transistor at Bell Labs in 1947 changed the course of technology. This small device, which could amplify and switch electrical signals, eventually replaced the larger, more power-hungry, and less reliable vacuum tube. In 1958, Jack Kilby of Texas Instruments and Robert Noyce of Fairchild Semiconductor independently created the first integrated circuit (or chip), which combined multiple transistors into a single device. This invention marked the beginning of the silicon era and the birth of the chip industry.

In the early years, the products lacked commercial demand and found use in military applications. The fact that the US was falling behind in the space race provided the necessary impetus for computing demand. Fairchild Semiconductor received a large order from NASA for the Apollo mission (the mission that put man on the moon in 1969). Meanwhile, Texas Instruments received a large order from the US Air Force for a missile guidance system.

In the 1970s, companies such as Intel and AMD emerged as major players in the industry, with Intel introducing the first commercially available microprocessor, the Intel 4004, in 1971. The invention of the microprocessor led to significant advances in computing and other technologies, fueling the rise of personal computers in the 1980s.

Beginning in the 1980s and continuing into the 21st century, the semiconductor industry expanded beyond computers to include an ever-widening range of applications, including cell phones, Internet of Things (IoT) devices, and artificial intelligence systems. Furthermore, a global division of labor emerged, with some companies, such as Intel, designing and manufacturing their own chips, while others, such as Apple and Qualcomm, design chips but outsource manufacturing to companies like TSMC.

Current industry panorama

Considering the importance of the industry, it is surprising how concentrated it is.

Companies like Apple, Nvidia, and AMD play an important role, but they are only responsible for designing the chip. To develop this project, these companies rely on software whose technology is mastered by just four companies (three American and one German), which together hold 90% of the global market: Synopsis, Cadence, Ansys, and Siemens.

Once the design is complete, it is sent to one of the chip manufacturers. Depending on the complexity of the product, there are only two or three companies in the world capable of producing them: TSMC (Taiwan), Samsung (South Korea), and Intel (USA).³ For chips with inferior technology, other companies step in, such as the American Global Foundries (a former AMD spin-off), the Taiwanese UMC, and the Chinese SMIC.

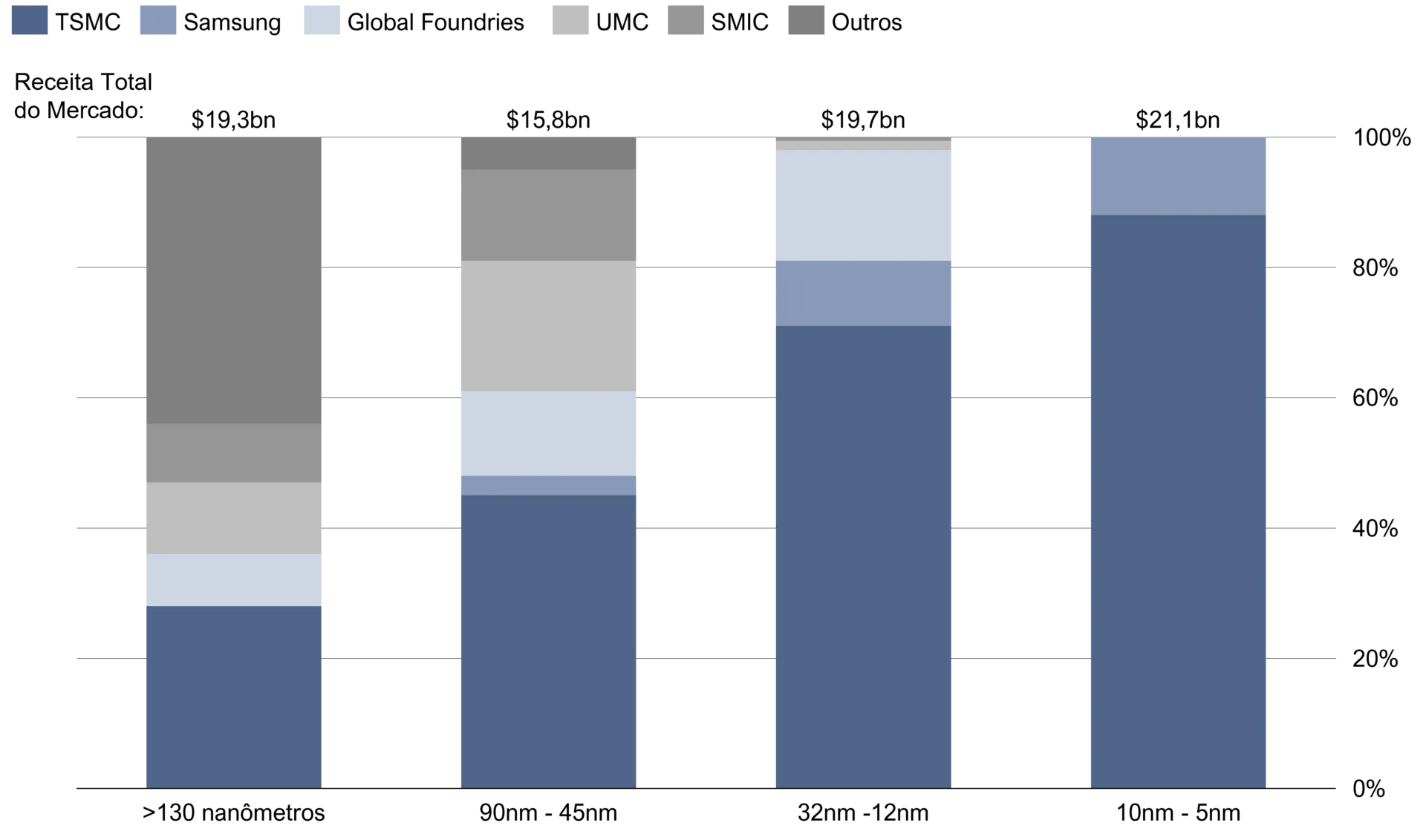

TSMC's dominance in this market is striking – for the most advanced chips, with nodes below 10nm, it has a 90% market share. Even for lower-end nodes, the company holds a dominant position, with a market share exceeding 50%. Details are available in the chart below.

Chart 1 – Market share of non-integrated chip manufacturers by node, 2020 data

Source: Bain/IC Insights/Gartner

Note: In the graph, the bars on the right represent the most advanced chips (with the smallest distance between the elements)

Companies like Apple and Nvidia ended up becoming more famous, the first for being the most valuable in the world, and the second for being the best prepared to surf the AI wave (which made its shares jump an incredible 175% in 2023), but both are extremely dependent on TSMC - 100% of both chips are manufactured by the Taiwanese company.

TSMC can design its customers' silicon designs using some of the world's most precise machines, which etch, deposit, and measure layers of material in nanometers (20,000 times smaller than a strand of hair). These machines are produced primarily by five companies: one Dutch (ASML), one Japanese (Tokyo Electron), and three American (Applied Materials, Lam Research, and KLA), each focusing on a different stage of the process.

ASML in particular (the largest company in the Netherlands by market cap) is the sole holder of EUV lithography technology.4, which is essential for engineering the chip design into silicon layers. Each of these machines has an average cost of USD 150 million (few companies can make such an investment—only TSMC, Samsung, Intel, and memory chip manufacturers like SK Hynix and Micron) and is the product of a three-decade investment by ASML. Today, the company reaps the benefits, as it is essential for the production of the most advanced chips and there are no substitutes—it is said that ASML has been free of competitors for this technology for several decades.

And how did we end up in this situation? Where such an important industry is dominated by so few companies?

Across the chip industry, the past few decades have seen consolidation. There are two reasons for this: the first is that several parts of the chip manufacturing process are brutally capital-intensive, with very expensive machinery. This discourages competition, as a new entrant must invest billions of dollars before knowing whether their product will even work.

The second is that the level of knowledge required to manufacture this equipment is highly specific and requires practical experience; it's not something that can be taught theoretically in college. This means that the companies that own these technologies have on their staff the vast majority of people in the world with the necessary knowledge, making it very difficult for a new entrant to emerge in the industry.

Geopolitical dilemma

The importance of chips goes beyond economic aspects; they have also played a fundamental role in military applications, contributing to technological advancements in areas such as communications, surveillance, intelligence, and weapons. During the Cold War, for example, the US's pioneering use of this technology was a decisive factor in its victory over the Soviet Union.

In today's world, chips play an even more important role, especially given that military and intelligence systems will increasingly rely on artificial intelligence. AI systems are trained in data centers filled with sophisticated chips. If a country lacks the technology to manufacture such chips, it won't be able to train AI systems. And this is what the US is banking on in its conflict with China.

In this context, the US has taken measures to restrict China's access to advanced semiconductor technologies. For example, several Chinese companies have been placed on a US Department of Commerce list restricting their ability to purchase US semiconductor technology. At the same time, American and allied companies (such as ASML, Tokyo Electron, Applied Materials, Lam Research, KLA, and even TSMC) face a series of restrictions that prevent them from selling their most advanced products to China.

In response, China has invested heavily in developing its own semiconductor production capacity, although it still has a long way to go to reach the technology level of major chipmakers.

Additionally, there is the issue of Taiwan. China has claimed Taiwan as part of its territory, which has been a constant source of tension between China, Taiwan, and the US, which is a major supporter of Taiwan. Any conflict in Taiwan or an attempt by China to exert more direct control over the region would have significant implications for TSMC and, consequently, for the global semiconductor supply chain.

To protect itself from a potential escalation of the Taiwan conflict, the US passed the Chips Act in 2022. The law allocates USD 280 billion for investment in chip research and manufacturing in the US, aiming to reduce American dependence on chips manufactured in East Asia, especially the most advanced ones. The law's passage has already attracted investment from companies such as Intel, Global Foundries, Samsung, and even TSMC – all of which intend to build factories in the US in the coming years. Despite the hefty check, many are skeptical about the impact these investments will have on changing the global production structure, given that each factory is incredibly expensive (a cutting-edge factory costs between USD 20-25 billion to build, and it only has cutting-edge technology for a few years), and the fact that production in the US is inherently more expensive than in Taiwan, especially due to higher costs for key resources such as personnel, land, water, and electricity, stricter environmental regulations, and a harsher tax regime.

How this entire dynamic unfolds is something to be closely monitored in the coming years.

Impact on investments

From an investment perspective, there are two ways to think about how to act.

The first is to identify potential opportunities within the industry itself, as it certainly has quite attractive characteristics: it's an essential product for the global economy, with clear growth trends and a large number of dominant companies in their respective segments. Given these characteristics, we analyze companies and monitor stock prices to potentially invest at a time when prices are appropriate.

One company that particularly stands out is TSMC. As we've seen, it has a dominant competitive position, and considering its growth and profitability history (it has grown at a rate of 22% per year for the past 30 years, with a ROE consistently in the 20-30% range), one would expect it to trade at high multiples. However, it is currently valued at USD 465 billion.5 and trades at a multiple of 14x trailing 12-month earnings—low considering the company's quality. However, its presence in Taiwan places the company in a fragile position given the constant threat of Chinese invasion, which could pose a threat to its investment in TSMC. Mega-investor Warren Buffett was an investor in the company but sold his shares in early 2023. When asked why, Buffett responded that he considers TSMC one of the best-managed companies in the world, but dislikes its location.

The second approach is to consider second-order impacts, especially how the evolving dynamics of this industry could impact the global economy. A major concern is a potential war or blockade in Taiwan, which could have near-catastrophic impacts on the global economy. If the chip shortage seen during the pandemic is any indication, we'd likely go one or two years without replacing our cars, and the same level of disruption would be seen in several other industries, such as cell phones, computers, and home appliances.

In addition to seeking new investment opportunities in this industry, we are also closely monitoring the impacts that changes in the semiconductor supply chain may have on our portfolio companies. Given the importance of this topic to the global economy, we will continue to monitor it closely in the coming years.

1 Number of transistors in Apple A16, microprocessor in iPhone 14 Pro

2 2020 data shows that TSMC has a market share of 90% in chips with nodes smaller than 10nm

3 Intel is the only company that still designs and manufactures its own chips. Given its dual focus, it ended up losing the race to pure-play manufacturers (especially TSMC), and managed to launch its most advanced technology products only several years after its competitors.

4 Extreme ultraviolet lithography

5 Considering closing prices on 02/06/2023