Dear investors,

Concern about a possible return of inflation has been growing worldwide. Brazil is no different: inflation expectations for 2021 have been rising consistently in recent weeks. The latest Focus bulletin already points to an expected IPCA of 4.85% in 2021 (compared to 3.32% at the beginning of the year). In an attempt to address this situation, the Central Bank raised the Selic rate from 2.0% to 2.75% in the last cycle. Economists still expect further rounds of interest rate hikes by the end of the year. These interest and inflation levels are still much lower than what we've experienced in Brazil for many years, but perhaps precisely because of our track record, any indication of a return to inflation is viewed with concern. Given this scenario, in this report we seek to present how stocks behave in inflationary environments, based on historical evidence that supports our view.

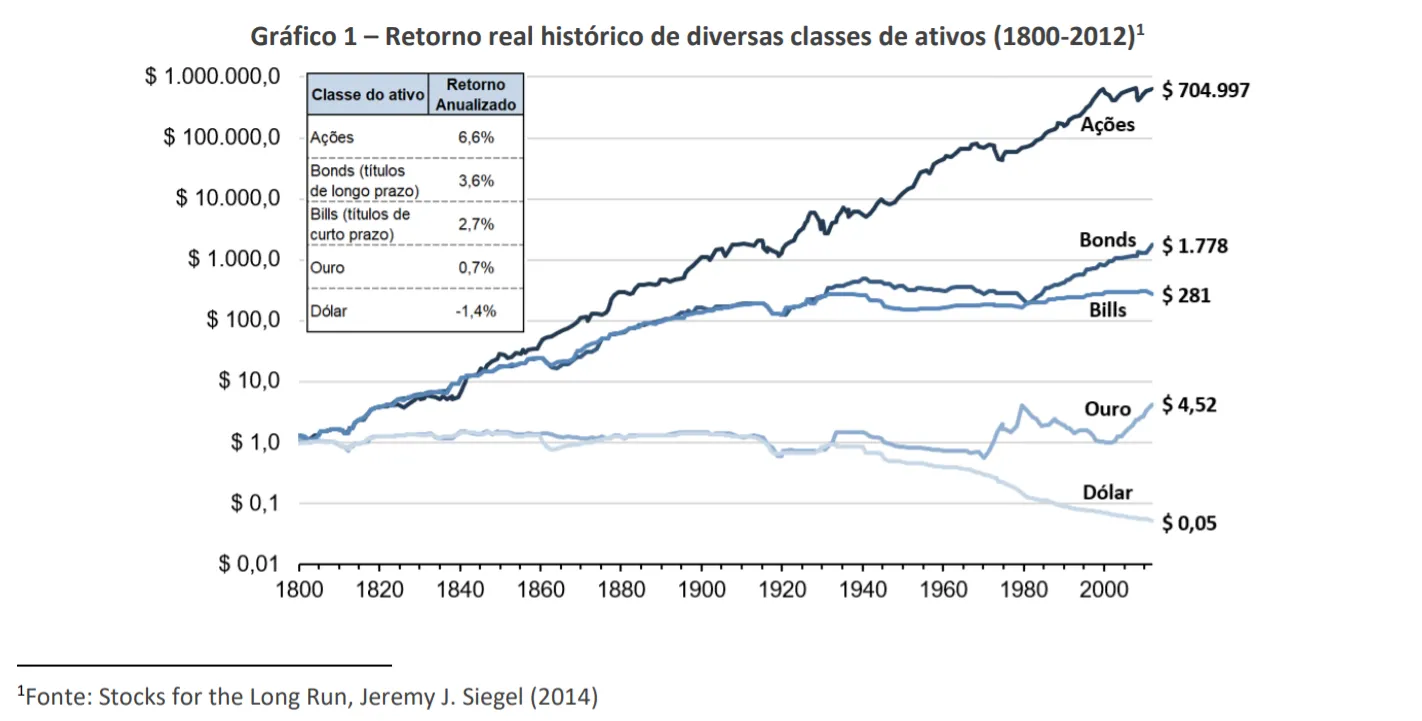

In the chart below, we revisit an analysis we presented in our May 2020 letter ("Stocks vs. Fixed Income – Part 1"), which shows the returns of various asset classes in the U.S. market over the very long term. The chart presents historical inflation-adjusted returns from 1800 to 2012.

The graph illustrates how stock returns are incredibly stable over the very long term, growing practically in a straight line (logarithmic scale) with small fluctuations over time.

What's interesting to note from the graph is that the analysis can be divided into two very different periods in terms of inflation. Until the 1930s, the price level in the US was practically the same as in 1800 (there was no inflation for a period of 130 years!), and since then, price levels have risen consistently, with inflation occurring every year. Even with such different inflation scenarios, real stock returns were practically the same in both periods.

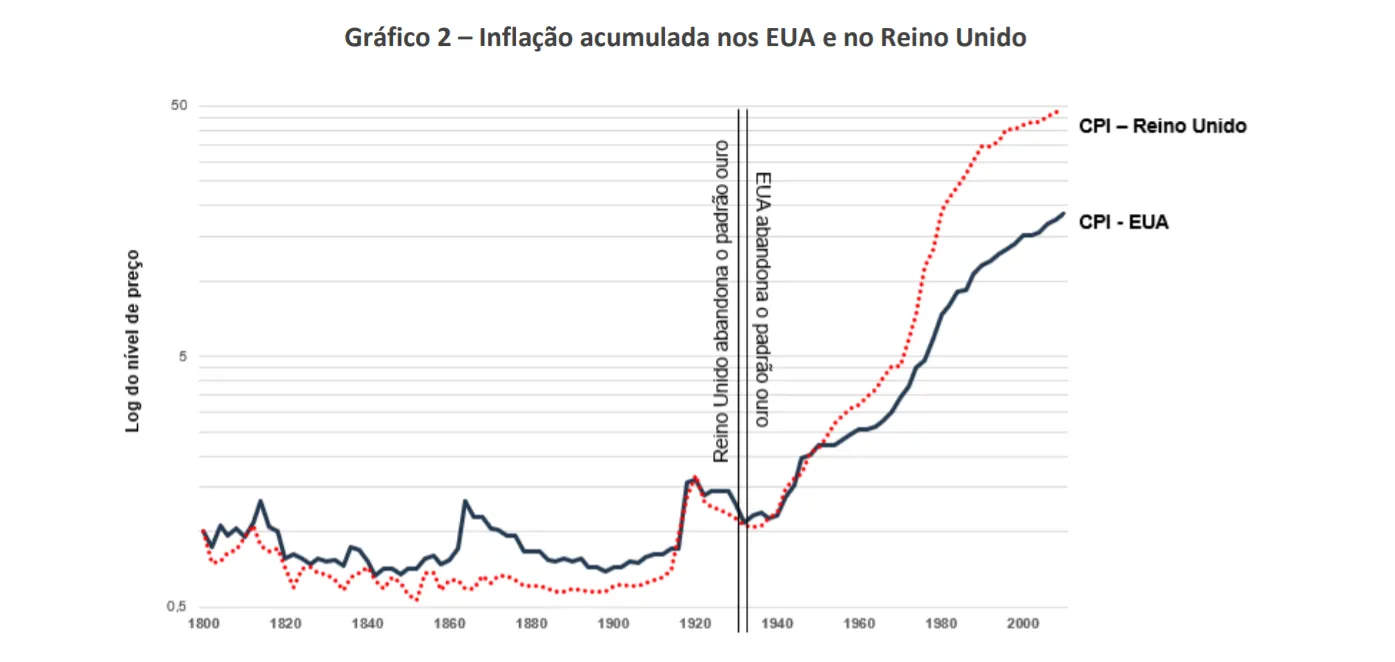

Chart 2 below shows cumulative inflation in the US over time.

The reason for this dramatic shift in inflation was the end of the gold standard in the United States and the United Kingdom, which gave central banks the flexibility to increase the money supply in the economy. This increased flexibility brings some benefits, as it enables stimulative monetary policies in crisis situations, but on the other hand, it also poses the risk of inflation. Graph 1 also highlights this effect, as until the 1930s, the value of gold and the dollar were closely linked. This link has since ceased to exist.

Why do stocks perform well in different inflation scenarios?

Stocks represent shares in companies, and their value is tied to the price of the goods and services they offer. Since the price increases of such goods and services are what drive inflation, stocks are naturally protected against inflation.

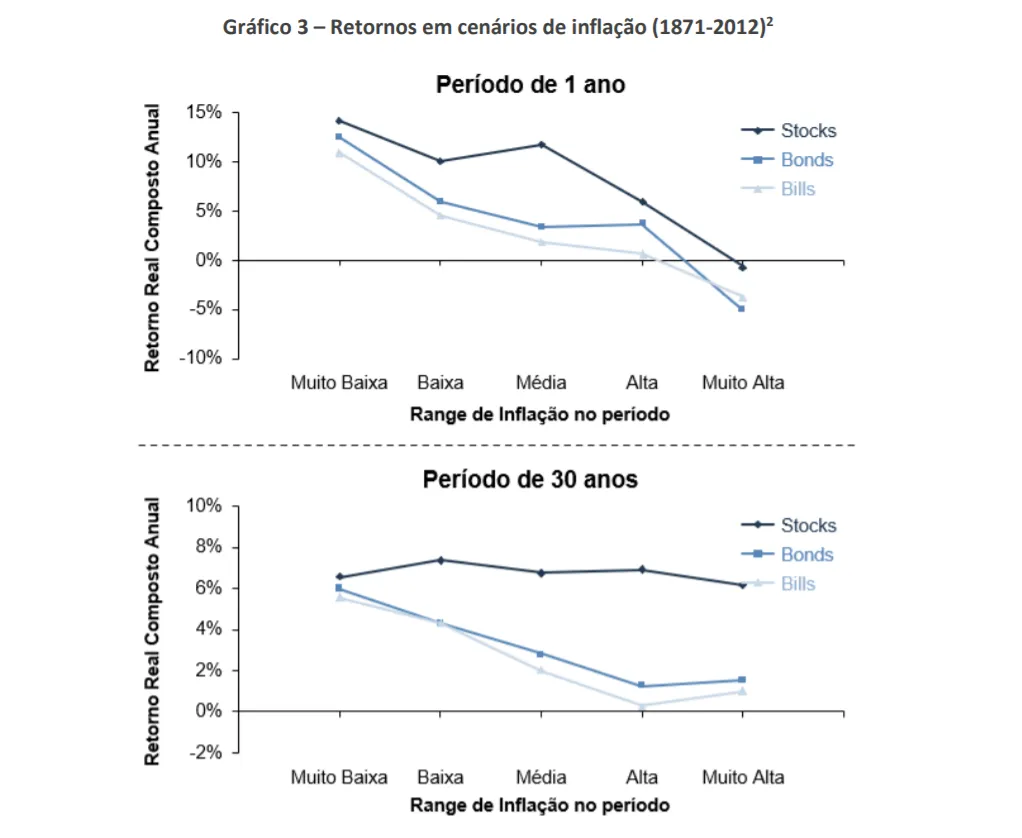

The evidence shows that this finding holds true in the long run, but not in the short run. The graphs below present real stock returns in different inflation environments, in two scenarios: (1) long-term (30-year investment period) and (2) short-term (1-year investment period).

The data indicate that, as previously indicated, over sufficiently long periods, the inflationary environment matters little in determining stock returns. However, in the short term, stocks ultimately benefit when inflation is low.

There are several reasons for this poor short-term performance. One is that, with higher inflation, there is an expectation of interest rate hikes by central banks, which in turn is usually followed by an economic slowdown and a consequent devaluation of stocks.

Another important reason is that, in many situations, price increases do not spread simultaneously across all sectors, harming the performance of companies that have greater difficulty passing on their prices.

One example was the oil shock of the 1970s. At the time, due to supply constraints in OPEC countries, commodity prices more than tripled in just a few months. This increase put pressure on the costs and margins of many companies, which took years to pass on the price increases to their consumers, which consequently pressured their market value.

This situation leads us to an important conclusion: companies with pricing power are naturally protected in inflationary scenarios because they are able to absorb increased costs more easily.

²Source: Stocks for the Long Run, Jeremy J. Siegel (2014)

What does the evidence show for Brazil?

Similar to the United States, stock investments in Brazil have historically been quite profitable, despite being much more volatile. This level of profitability was achieved despite a history of hyperinflation for many years.

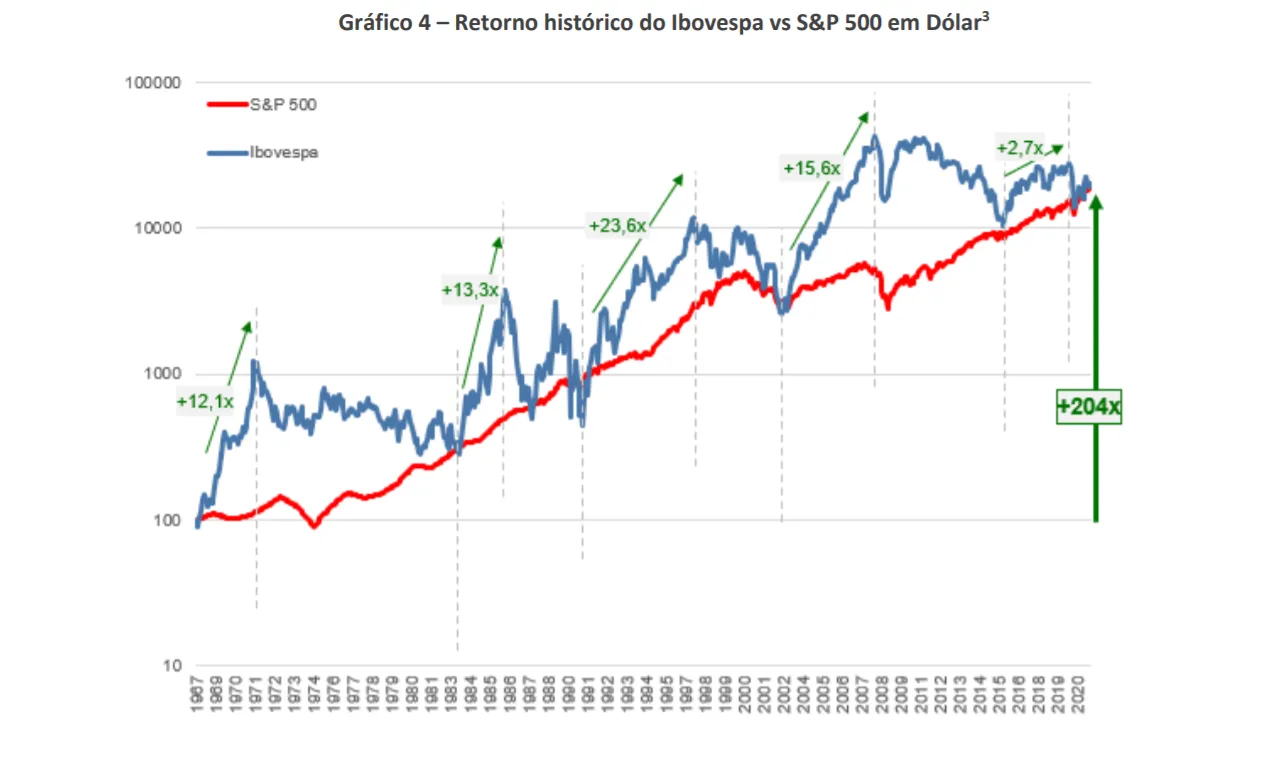

Since the creation of the Ibovespa, in Jan/1968, until Mar/2021, the Ibovespa had a real return (above inflation) in dollars of 26.3 times (equivalent to an annual rate of 6.33% per year), compared to 25.3 times for the S&P 500 (6.26% per year) in the same period.

At Ártica, we focus our investments on excellent businesses, and one of the defining characteristics of these businesses is their ability to pass on prices in the most adverse environments. This selection criterion, combined with our long-term focus, is how we seek to protect ourselves from inflation.

³Source: Análise Ártica; Data presented for the period between Jan/68 (beginning of Ibovespa) and Mar/21; S&P considering dividend reinvestment (SP500TR), whose data are presented annually between 1968-88, and monthly from 1988 onwards