Is it worth investing in an IPO?

Dear investors,

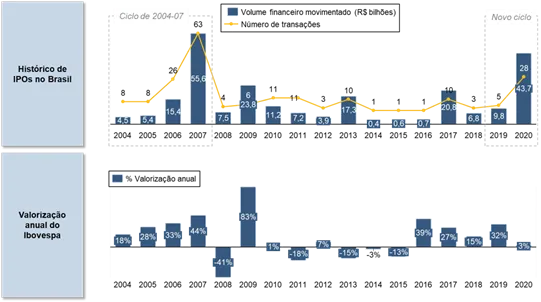

The Brazilian capital market is experiencing a new cycle of IPOs1Between 2019 and 2020, 33 companies debuted on the stock exchange, generating a total of R$54 billion. In 2021, we already had 9 IPOs.2, and there are over 30 offerings under review by the CVM. To give you an idea, between 2014 and 2016, we had only 3 IPOs!

This cycle is only comparable to the period from 2004 to 2007, when there were a total of 105 IPOs and a total turnover of R$1.4 billion.

Considering the similarity between the two periods, we have analyzed the historical performance of IPOs from this cycle, from 2004 to 2007, to try to answer the following question: is it worth investing in an IPO?

The chart below shows the history of IPOs in Brazil between 2004 and 2020 and illustrates the numbers cited in the introduction to this letter.

Chart 1 – History of IPOs in Brazil and annual appreciation of the Ibovespa

Source: B3, Analysis: Arctic

The fact that more companies are managing to go public is excellent for the Brazilian capital market, as it means that entrepreneurs are able to raise funds to finance expansion plans, which, in turn, generate new jobs and benefit the economy.

From our perspective, investors, IPOs increase the range of investment opportunities. In a country with few listed companies, newcomers to the stock exchange are very welcome.

As we mentioned in the November 2011 letter, Brazil had 316 listed companies at that time, a very low number when compared to countries with economies of similar size to ours, such as India, Canada and Australia, with 5,541, 3,948 and 1,967 listed companies.[3], respectively.

Despite these benefits, investors need to be selective in their asset selection. It's no coincidence that the periods with the highest IPO volume are precisely those when stock markets are booming (see chart 1 above), as this is when entrepreneurs understand they will be able to sell their shares at valuations attractions.

This is an important point: if entrepreneurs, who know much more about their own company than any investor, understand that it is a good time to sell, they must be careful when selecting what could actually be a good investment.

To illustrate this point, we analyzed the returns of stock market debutants from 2004 to 2007. At the time, the situation was very similar to today: competition among investors to participate in IPOs and huge share appreciations on the days of their debut.

Almost 15 years later, of the 105 listed companies, only 65 remain public. Of the 40 that were delisted, 22 were acquired or underwent M&A, 15 went private through a public offering, and 3 went bankrupt.

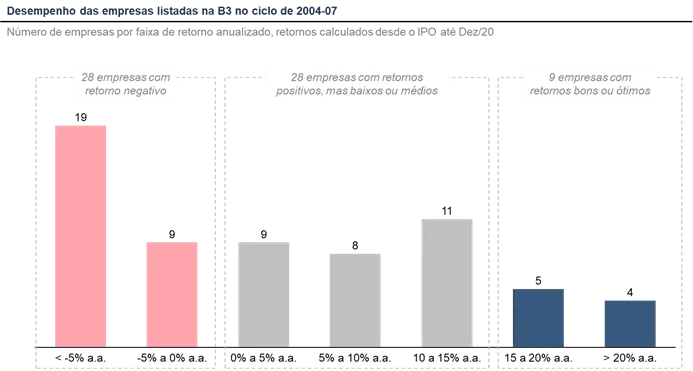

Of the 65 companies that remain listed, the average performance is not very positive. Only 26 companies outperformed the Ibovespa during the period.

More alarmingly, 28 companies (43% of those still publicly traded) posted negative returns. These include construction companies like PDG, Gafisa, Viver, and CR2; banks like Indusval and Pine; and mining company MMX (OGX, the most famous company in the X group, went public in 2008). All of these companies experienced significant capital losses, in some cases as much as 99%.

Of the remaining companies, 28 had low or average returns (between 0 and 15% per year), and only 9 had good or excellent returns (above 15% per year). The chart below illustrates this data:

Chart 2 – Dispersion of returns of listed companies between 2004 and 2007

Source: Economática, Arctic Analysis

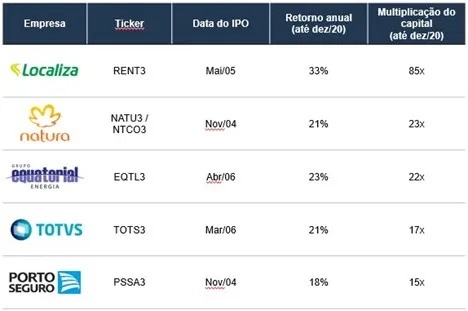

Despite the poor average results, the 2004-2007 period brought excellent companies to the stock market, which were able to generate significant value for their shareholders. Among them, highlights include Localiza, Natura, Equatorial, Totvs, and Porto Seguro, all with at least a 15x increase in invested capital.

Chart 3 – Most successful IPOs of the 2004-07 cycle

Source: CapitalIQ, Arctic Analysis

If history repeats itself, which seems likely, the IPO cycle we're currently experiencing should yield companies with a wide range of performance. Discipline in selecting the best opportunities, investing in good companies that are trading at fair prices, is what makes the difference in the long run.

1 Advisory (“initial public offering” in English, or “initial public offering” in Portuguese) represents the first time a company's shares are offered to the market. After the IPO process, the company becomes a publicly traded company.

2 Until February 11, 2021

3 In 2017