Book Suggestions

Dear investors,

Continuing our initiative from last year, we're reserving our final letter of the year to suggest five books related to investment. As a criterion, we prioritize books we really like but may not be as well-known to the general public.

“An investment in knowledge pays the best interest.” – Benjamin Franklin

More Than You Know: Finding Financial Wisdom in Unconventional Places

First published in 2008, this book has won several awards and has been recognized by Porchlight as one of the 100 best business books of all time.

In a way, it is a precursor in the application of behavioral sciences in the investment business, something that has become much more popular in the last decade especially after the publication of Thinking Fast and Slow in 2011. Rather than developing a theme or thesis in a prescriptive way, the book is structured around a collection of 50 articles, which can be read independently, with some provocative ideas and insights of the most current theories at the time of publication, such as:

Investors tend to assume linearity in their business projections, when in reality, a company's growth tends to follow an S-curve. This means that people underestimate the growth potential of fast-growing companies and overestimate growth as businesses mature.

Financial models that imply an exact price for a stock are less useful than models that calculate the business's value under multiple scenarios and assign probabilities to each scenario. One suggestion the author makes is to have one analyst develop an economic-financial model for the company and then have a second analyst assign probabilities to each scenario, approaching a scientific double-blind method.

Studies indicate that a group of people with no specific knowledge can solve problems as well as individuals who are experts in the subject.

Being patient and diligent, and following a solid investment process, is more important than sporadically delivering excellent investment results. A good result doesn't justify a poor process. But even if a good process can sometimes produce a poor result, in the long run it will outweigh a poor process. While this may seem obvious to some, the truth is that most fund investors pay very little attention to the robustness of the investment process.

From time to time, it's interesting to revisit some of these ideas, especially since they don't cease to be true simply because they've been 'dropped into the media.' One example is the Kelly Criterion, very well applied to investment management by Edward Thorpe (see last year's book suggestions). Although it's a theory developed in the 1950s, it remains little taught today.

Michael Mauboussin, author of "More Than You Know," brings to his resume an interesting blend of academia and investment practice. He currently leads the research department for Morgan Stanley's Counterpoint Global long-term equity fund and is an adjunct professor of finance at Columbia Business School in New York.

It's a quick and thought-provoking read on investment topics for both beginners and professionals.

The Quest: Energy, Security, and the Remaking of the Modern World

Title in Portuguese: The Quest: Energy, Security, and the Remaking of the Modern World.

In these times when a liter of gasoline costs more than R$7.00 in many states, reading this book is essential to understanding the economic and geopolitical dynamics of energy markets.

Written by one of the greatest authorities on the subject, Daniel Yergin, this book can be considered a sequel to the 1992 publication, “The Prize,” which tells the history of oil between 1850 and 1990.

"The Quest" begins by recounting the evolution of the oil industry from the first Gulf War onward, describing its trajectory until the dissolution of the Soviet Union into more than a dozen republics. But the book goes beyond the oil industry, offering a comprehensive overview of the global energy market and its geographic, political, and technological interdependencies.

To provide context for the political environment surrounding this industry, the book discusses issues related to countries' energy security and the challenge of accessing reliable and economically viable energy sources to support their growth. It also provides extensive detail on China, which has been the deciding factor in recent decades.

The importance of electricity in today's world receives a dedicated section in the book. The history of the development of this ubiquitous form of energy has been recounted several times, but Daniel does so succinctly and masterfully, also discussing the challenges of maintaining such a comprehensive and complex system operating 24/7 without interruption. Here, an explanation of nuclear energy is in order, which took a while to gain credibility as a source of electricity generation after the American bombings of Japan during World War II. During the 1970s, it had its glory days, but eventually fell into disrepute due to accidents like Chernobyl and Fukushima. With this context, for example, we can better understand why the topic has resurfaced, leading China to announce in early November a US$1440 billion investment in new nuclear reactors by 2030.

Another very current topic for which "The Quest" provides excellent context is the carbon market. Celebrated during the last COP26 in Glasgow, this global agreement aims to reduce the use of fossil fuels through a mechanism known as "cap and trade”.

In a specific section, the book covers the history of climate science, the evolution of debates on global warming and how the introduction of a market for cap-and-trade significantly reduced emissions of gases containing SO2, the main culprit behind acid rain.

Finally, it's worth mentioning the discussion about the future of the automotive market and the potential adoption of electric cars. At the time of the book's publication, Tesla had just completed its IPO, the first automotive company to go public since Ford in 1946!

Yergin's writing style is very fluid, making reading its more than 800 pages a pleasure.

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

Title in Portuguese: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness.

This is one of the best personal finance books we've read recently. It's very well written and offers in-depth, high-quality content in a simple, straightforward manner.

Unlike many other books in its genre, "Psychology of Money" doesn't attempt to present specific tactics or formulas for quickly building wealth. Author Morgan Housel uses 19 stories of how people managed their money to explore the mental models and behaviors that shape much of our financial success.

The premise behind the book is that making money has little to do with how smart you are, but a lot to do with how you behave. A genius who easily loses emotional control can be a financial disaster (see the next review for a historical example!). On the other hand, the opposite is also true. Ordinary people, with no financial education, can become wealthy if they develop behavioral skills that have nothing to do with formal measures of intelligence.

- Less ego, more wealth: Our ability to save money is the difference between our ego and our income. Most of our spending on things and possessions (which feed our ego) hinders our financial freedom and future options. "Spending money to show people how much money you have is the quickest way to have less money."

- Longer investment horizon means better returns: It sounds simple, but in practice it's difficult to achieve. People admire Warren Buffett's investing skills, but his real secret is time and patience—his fortune is the result of over 75 years of investing, and 99.61 trillion of his fortune (nearly US$100 billion) was acquired after he turned 52!

- Good investments do not necessarily mean getting the highest returns, because the biggest returns tend to be one-off successes that can't be repeated. It's about achieving very good returns that you can sustain and that can be repeated over a long period.

- The greatest intrinsic value of money is its ability to give you control over your time.

- A “Reasonable Strategy” is better than a “Rational Strategy”Reasonable is what works for you. Taking undue risks to maximize every penny of return may not be sustainable in the long run. This is a point we discussed in more detail in our previous letter.

Money for Nothing: The Scientists, Fraudsters, and Corrupt Politicians Who Reinvented Money, Panicked a Nation, and Made the World Rich

The “South Sea Bubble,” a financial boom that helped solidify nascent capitalism in 1720, is perhaps not as sexy and well-known as the Tulip Mania of 1637. It didn’t capture the popular imagination in the same way. However, by helping to invent markets for bonds (debt securities) and consolidating the financial sector's power of influence in modern politics, gave rise to the capital market as we know it today.

In the early 18th century, England was running out of money due to a prolonged war with France. Parliament attempted to raise additional funds by selling debts to its citizens, receiving money now with the promise of interest later. It was the first permanent national debt, but they still needed more.

Parliament then turned to the stock market – a relatively new invention in itself – and where Isaac Newton's scientific discoveries (calculus, planetary motion) were being tentatively applied.

The South Sea Company (South Sea Company), had been created to exploit the monopoly of trade between England and the Spanish colonies in the Caribbean. There was one small problem: Spain and England were at war (again), making any form of trade between these countries impossible.

While waiting for their traditional enemies to resolve their differences, the executives of the South Sea Company drew up complex business plans based on the actuarial tables of Newton and Halley (astronomer and discoverer of the comet that bears his name).

Therefore, the South Sea Company began to see their stock price rise, based not on anything they were manufacturing or selling, but rather on the putative value of their future plans. Buoyed by the "success" of the business, the company's directors began borrowing to buy more South Sea shares, using their own shares as collateral.

Stock prices doubled, doubled again, and then doubled again, causing everyone in London from Newton to the Prince of Wales to get caught up in the financial mania.

One thing that makes the book truly enjoyable is the context the author provides. The first third of the book shows what was happening in scientific thought and observation, mathematical theory, and monetary practice in the mid- to late-17th century. Without these changes, and the prevailing national debt, it's difficult to understand how the bubble could have happened when it did.

A second feature of the book is that it clearly explains many of the basic concepts needed to understand how the bubble started and how it was deliberately inflated.

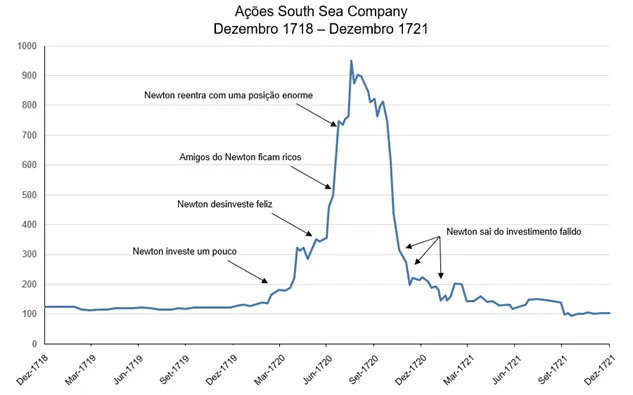

As a curiosity, this was the (approximate) performance of Isaac Newton, perhaps one of the most intelligent people who ever lived, with this investment:

Source: Marc Faber, Jeremy Grantham, Sir Isaac Newton

Invent and Wander: The Collected Writings of Jeff Bezos, With an Introduction by Walter Isaacson

The book is based on Bezos's letters to Amazon shareholders and speeches throughout his life. In a determined tone, Bezos discusses the values and culture he developed within Amazon and which he carries into his life and other businesses, such as the Washington Post and Blue Origin.

Shareholder letters go far beyond commenting on the company's annual results, exemplifying corporate strategy, long-term thinking, and customer obsession. As investors, we read many annual reports and letters from executives, but rarely do we find such clarity and objectivity as Bezos's.

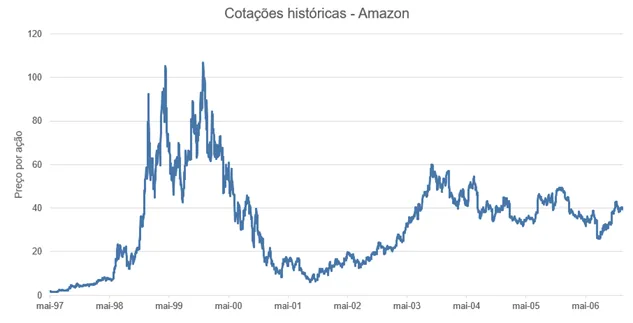

It's one thing for a successful entrepreneur to write about their trajectory after the fact. The narrative becomes much more linear, and many challenges or even factors of luck end up being forgotten or losing their due weight. It's another thing to read the "story being written." For example, this is a chart of Amazon's stock price around the year 2000:

Source: Capital IQ

And what did he write in the 2000 annual letter?OuchWhat a brutal year for the capital markets and especially for Amazon. As of the date of this letter, Amazon's stock is down more than 80% since the last publication. [...] But if the company is better positioned today than it was a year ago, why then has the share price fallen so much? As the famous value investor Benjamin Graham said, "In the short run, stocks are like ballot boxes, in which the most popular prevail; in the long run, they are like scales, in which the most substantial prevail." And the most fascinating thing is that from the moment Bezos wrote the 2000 letter until today, the stock has multiplied by more than 300x!

Among the points developed in the book, we highlight the following:

- Day 1 Mindset: Since the beginning of Amazon, the mindset of working as if it were the first day has been maintained, with the drive to tackle a new project and the energy and entrepreneurial spirit of being part of something great. We, as human beings, get complacent very quickly. The book's challenge is to approach each day with the same excitement we feel when starting a new personal project.

- It's all about the long term: The short term is very volatile, and this is true for both the financial market and companies' operational metrics. Focusing solely on the results of this quarter or the next blinds us to the structural and lasting changes of the coming years. We must plan and have a vision of where we want to be in the coming years and work accordingly to get there, knowing that the path to our goal may not be linear.

- Focus relentlessly and passionately on the customer: From the beginning, Amazon aimed to be the most customer-centric company in the world. More important than focusing on competitors, as other companies often do, Amazon maintained its focus on customers (customer obsession as opposed to competitor obsession). This is because, in Bezos's words, "customers are always beautifully, wonderfully dissatisfied, even when they report being happy and business is great," exerting constant pressure on the company to improve.

- Resist proxies: As companies grow larger and more complex, there's a tendency to focus more on formal processes than on the ultimate goal they're trying to achieve. A good process serves an employee so they can serve their end customer. However, if we're not careful, the process can become an end in itself. You stop looking at the end results and focus only on following the correct process. In his own words, "It's not uncommon to hear a leader defend a poor outcome with something like, 'Well, we followed the process.' A more experienced leader will use this as an opportunity to investigate and improve the process. The process isn't the thing. It's always worth asking, 'Do we own the process, or does the process control us?'"

- Decision making: Some decisions have profound consequences and are irrevocable. These decisions must be made calmly, analytically, and methodically, with considerable deliberation and consultation. However, most decisions are not irrevocable, but rather revocable. The beauty of these decisions is that they can be made even without broad consensus and broad access to all information. 70% of information should already be sufficient for capable individuals to make them. Beyond that, time is probably being wasted.

In addition to several insights like these, the book features a light-hearted and humorous narrative, characteristic of Bezos, and tells a series of anecdotes about the history of Amazon, from the beginning, when they still dreamed of having enough money to buy a forklift, to the present day.

Whether you're an experienced investor or just starting out, we believe the books above will offer valuable lessons and a good dose of fun. Special thanks to our friend Gustavo Baltar, who recommended some of the books in this review. Without further ado, enjoy your reading!