Is it a good time to invest in the Ártica fund?

Dear investors,

We're frequently asked by our shareholders: "Is now a good time to make new contributions to the fund?" Even among us, before this study, there was no consensus on this answer. Internally, some preferred to wait for the "ideal moment" to contribute, while others preferred to contribute smaller amounts more frequently.

With this in mind, we decided to simulate the return of two investment strategies in (A) the Ibovespa index, since the beginning of the Plano Real (July/1994), and in (B) the Ártica Long Term FIA fund, since its founding (June/2013): strategy (i) buy the dip, where you know exactly what the minimum point of the index is between two maximum points – and while you are not investing, the money yields 100% of the CDI – and (ii) recurring contributions, where the same contribution is made monthly.

Although we intuitively imagine that the first strategy would be much superior to the second, we were surprised to note that the recurring contribution strategy is not far behind, even though the buy the dip assume an unrealistic situation of having perfect information and historically interest rates in Brazil being high.

Methodology

To perform this simulation, we consider an individual who has R$1,000 (in 2021 current currency) available to invest each month. Furthermore, since July 1994, this individual has received a salary adjustment once a year equivalent to the IPCA for the period, also adjusting their available investment amount.

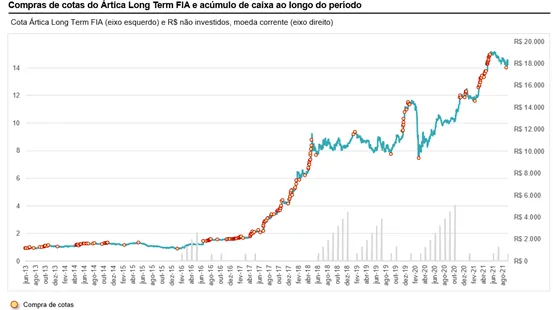

For strategy (i) buy the dip, the individual buys shares of Ibovespa/Ártica Long Term FIA exactly at least between two periods of all time high, that is, at the lowest value between the maximum peaks. During the period in which he does not make this investment, he invests his amount in fixed income, yielding after-tax 85% of the CDI[1] until a new purchase occurs. Furthermore, there are no sales of shares once purchased (buy and hold). Below, you can graphically view the purchase periods and the total cash balance (invested in CDI) available in the portfolio for the simulation of the Ibovespa and Ártica Long Term FIA:

1 We are considering a yield of 100% of CDI and an Income Tax rate of 15%, resulting in 85% net of CDI.

Graph 1.A – graphical representation of strategy purchases (i) buy the dip – Ibovespa

Chart 1.B – graphical representation of purchases from the (i) buy the dip strategy – Ártica Long Term FIA

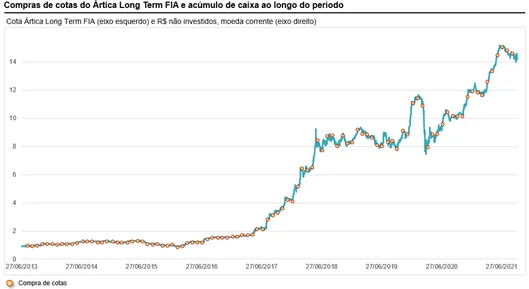

For the second recurring contribution strategy, the individual purchases all available funds in Ibovespa shares on the first day of each month, regardless of market conditions. Below, you can graphically visualize the purchase periods for the Ibovespa and Ártica Long Term FIA:

Gráfico 2.A – representação gráfica das compras da estratégia (ii) aportes recorrentes – Ibovespa

Gráfico 2.B – representação gráfica das compras da estratégia (ii) aportes recorrentes – Ártica Long Term FIA

Results

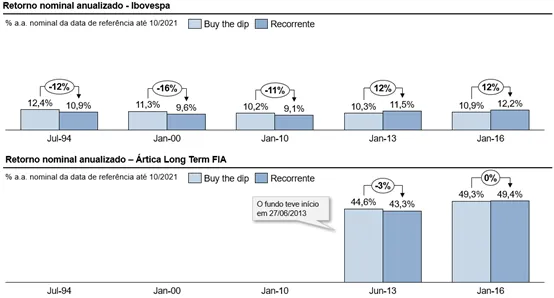

Using October 1, 2021 as the end date of the analysis, we have the following results for different start dates:

Chart 3 – results of strategies for different start periods

Since the Real Plan, for the Ibovespa the strategy buy the dip obtained a nominal annual return of 12.4%, +1.5p.p. above the recurring contribution strategy, or in other words, the recurring strategy obtained 88% of the total return of the strategy buy the dip. For Ártica Long Term FIA, since its founding in June 2013, the recurring contribution strategy has obtained 97% of the strategy's return buy the dip – which obtained a return of 44.6%.

Considerations and conclusion

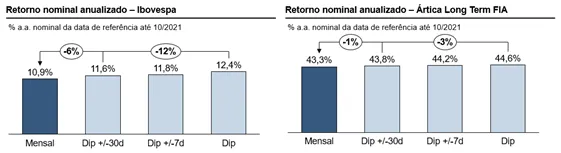

Some considerations need to be made regarding the results obtained. The first is that it is simply impossible to consistently predict the timing perfect for making strategic contributions buy the dip. If there were a 30-day advance in contributions, the recurring strategy would obtain 94% of the strategy's return buy the dip for the Ibovespa, as can be seen in the graph below, where the annualized nominal returns are simulated if the contribution varied +/- days in relation to the date of the dip consistently for the Ibovespa and for the Ártica Long Term FIA:

Graph 4 – strategy results for different errors

This result is interesting because it demonstrates, especially for the Ibovespa, that a small deviation already brings the profitability closer to the recurring contribution. For Ártica Long Term FIA, given its consistent results, the variation is smaller, since the share delivered good returns at different entry points.2In this context, it's also important to consider that, as human beings, we will certainly fail in our investment discipline throughout our wealth accumulation period. A slip-up in strategy "buy the dip", such as missing one or two windows for a new investment, can have a much greater impact on the portfolio's final return than one or two months in which we fail to make a recurring investment. Another consequence of this is the stress of keeping an eye on the market, trying to predict whether it has already reached its peak. bottom apparently does not compensate for the expected extra return.

The second consideration is that interest rates in Brazil in the late 1990s and early 20th century were structurally higher, which improved the profitability of the strategy's money. buy the dip that was not invested. From the beginning of the Real Plan in 1994 until the end of 2010, the CDI yielded 21% per year. Even with the most recent upward trend in interest rates in Brazil, the market consensus still points to an interest rate level of 10.25% per year by the end of 2022, well below the historical average.

The third consideration is that if the Ibovespa had a more continuous upward trend and we excluded periods in which the stock market had strong drawdowns, the recurring contribution strategy would be even closer to the strategy buy the dip.

Within the management firm, we frequently question the ideal investment strategy for Ártica Long Term FIA. It's worth remembering that a significant portion of the personal wealth of many of Ártica's partners and employees is invested in the fund. Among our founding partners, we have some who have historically advocated for recurring contributions and others who preferred to wait for the apparent greatest discount to invest. We analyzed the returns for both, and the result was unusual: for the first, who has made 51 contributions since the fund's inception, the annualized IRR is 41.4%. For the second, who has made 23 contributions seeking to be more assertive during downturns, the annualized IRR is 40.0%.

The purpose of this letter is not to provide a definitive answer to the topic, and we understand that the research is not exhaustive. But the main finding is valid: the recurring contribution strategy has a profitability sufficiently close to the best. timing possible, you don't need to frantically follow the stock market and political news and you free up space for your professional and personal development – while the compounding does its job.

2Rentabilidade passada não é garantia de retorno futuro.