Investment Case: Long-short in Bradespar-Vale

Dear investors,

In this memo, we share with you an unorthodox arbitrage investment we carried out between 2018 and 2019 that yielded excellent results. It's a good example of leveraging risk-return asymmetry to the investor's advantage.

The transaction consisted of the purchase of Bradespar shares accompanied by the sale of Vale shares.

Bradespar is a holding publicly traded company founded by the controlling block of the Bradesco Group with the objective of investing in assets traded on the stock exchange and diversifying the Group's capital.

After selling its entire stake in CPFL Energia in December 2017, Bradespar's sole investment in its portfolio was Vale, a company in which it has been a partner since its privatization. Thus, Bradespar effectively became a vehicle for indirect investment in Vale.

Como é comum em casos similares (observados em Gerdau – Metalúrgica Gerdau, Itaú Unibanco – Itaúsa, Iguatemi – Jereissati Participações, dentre outros), a Bradespar é cotada com um desconto de seu NAV1 – that is, it is worth less on the stock exchange than the market value of its stake in Vale. This discount is called a holding and exists due to the fact that the intermediate vehicle – the holding – add an additional layer of uncertainty to the asset, since it can apply the resources from its investment (dividends, interest on equity and sales of shares on the market) at its discretion, and may even allocate them to low-profit activities, destroying value for its shareholders.

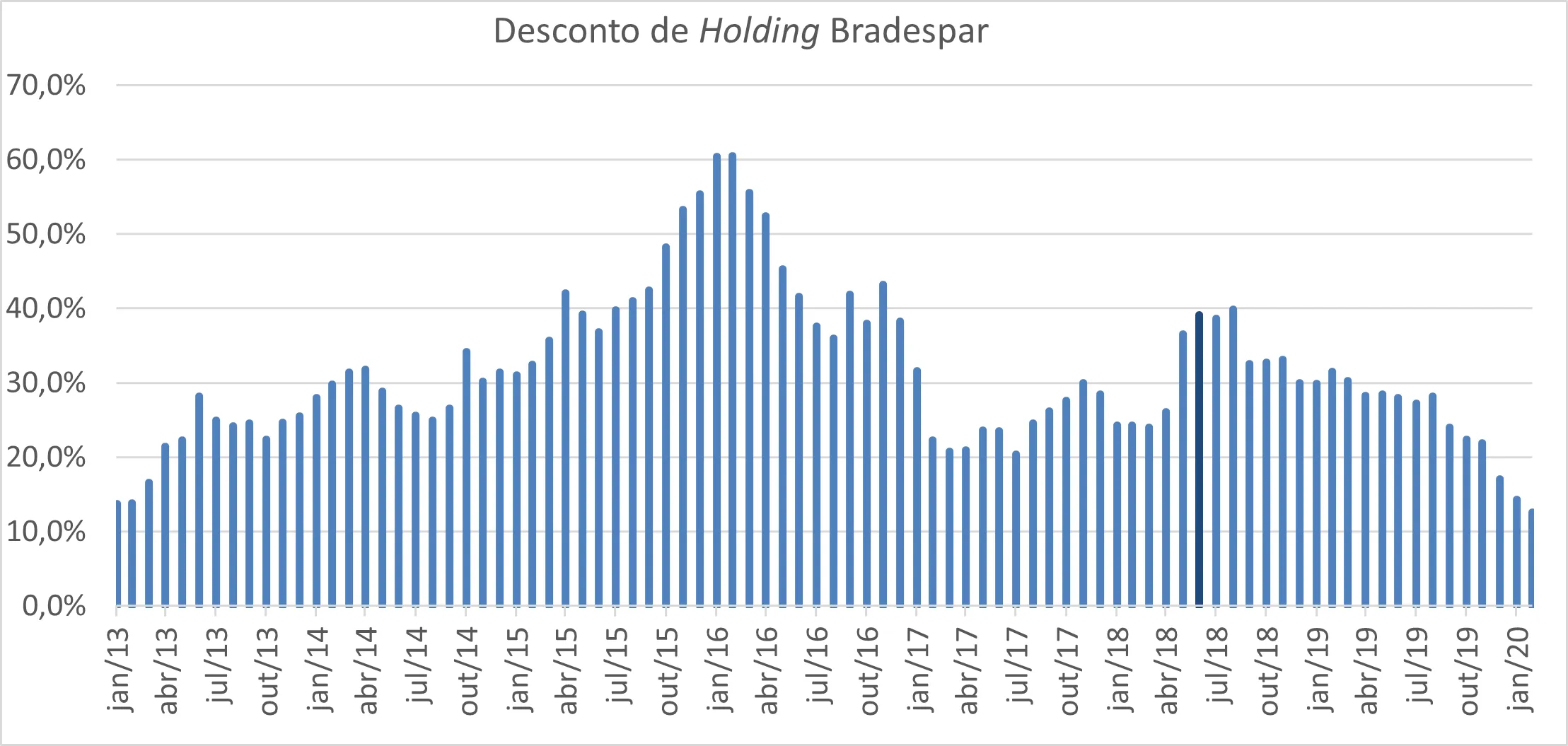

In general, the discount of holding observed in similar cases fluctuates around 20% of NAV, which, historically, can be observed at Bradespar2

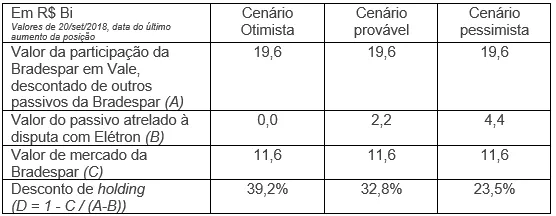

In 2018, there was a movement to increase the discount of holding due to a legal dispute brought by Elétron, a company of the Opportunity Group (owned by businessman Daniel Dantas). The dispute had been going on for 11 years and involved a lawsuit filed by Elétron against Bradespar and Litel. In May 2018, the court approved an expert report that stipulated compensation for Elétron in the amount of R$4.4 billion, of which Bradespar would be responsible for half.

The news caused Bradespar's holding discount to increase considerably (the discount reached 40%, as shown in the chart above). In our view, the increase was exaggerated: even assuming a scenario in which Bradespar covered 100% of the contingency, or R$ 4.4 billion, the adjusted discount would still be 23.5%, above the historical average of 20%. In our view, this would be the worst-case scenario.

To capture this opportunity, our investment should be positioned based on the discount of holding Bradespar, capturing the value in the return of the discount to historical levels. The way we found to structure this operation was through a long short3: we stayed long in Bradespar (BRAP4) and short in Vale (VALE3), so that losses generated by the appreciation of VALE3 were offset by gains from the appreciation of BRAP4 and that only the relative fluctuation between the price of BRAP4 and VALE3 affected our investment – an important point, since we did not want to bet on the absolute direction of the movement of these shares (which avoided, for example, a loss of capital for Arcádia after the Brumadinho accident, when Vale shares fell more than 24% in just one day).

The fact that it is a long short This gave the investment an interesting characteristic, as it didn't require large amounts of resources, as we used the proceeds from the sale of VALE3 to purchase BRAP4. In other words, it wasn't necessary to withdraw funds from other assets, or even from cash, to invest in the thesis.

We set up the operation between June and September 2018, when the discount of holding fluctuated around 39% until we reached the maximum limit allowed by the Arcádia regulations.

Since then, Bradespar, Litel and Elétron approved an agreement in which they agreed to total compensation of R$ 2.8 billion, well below the initial R$ 4.4 billion, divided equally between Bradespar and Litel (R$ 1.4 billion for each).

Litel attempted to legally charge Bradespar for the reimbursement of the R$1.4 billion it had paid, but recently, in December 2019, a court decision was released stating that the claim had been denied.

This news positively impacted the discount, which fell from 39% to the current level of 13% (as of February 2020). The reduction in the discount generated a great result for Arcádia – a total return of 91.2%.4 on the capital employed, which represents an annualized return of 47.7% until February 2020.

The question that remains is this: what would happen if the discount of holding increase instead of decrease? Although "on paper" the operation could have presented a negative result, in practice it was only a matter of time for the discount to narrow, as the market tends to correct significant value movements over time. And we had enough time to wait because, since we bought Bradespar "cheaply," the dividends received from the position long were greater than the cost of maintaining the position short – in other words, we were effectively being paid to wait and make money!

The case described above illustrates an alternative way to obtain a differentiated return combined with a significantly reduced risk exposure. This type of investment serves as an important complement to a portfolio and becomes even more attractive in times of bull market, when it becomes increasingly difficult to find good stocks at reasonable prices on the stock exchange.

To make investments like this, you need to be aware of the opportunities the market offers and exercise the same common sense and analytical skills that are naturally required for more traditional stock investments.

1NAV: Net Asset Value. Indicates the market value of assets discounted from the market value of liabilities.

2The peak of the discount holding observed in the graph (between 2013 and 2016) occurred when the end of Vale's Shareholders' Agreement was approaching, which was due to expire in 2017. However, the Agreement was renewed and returned to levels close to 20% in 2017

3Long: Invest in a share (profits occur when the share increases in value); Short: Betting against the stock (profits occur when the stock depreciates). Strategies long short are used for investments in which the thesis is the relative variation in the value of assets, not their absolute variation.

4Until 02/28/2020