Problems with the diversification thesis

Dear investors,

In January 2020, we sent a letter commenting on our portfolio management process and our strategy for determining the percentage of equity allocated to each position.

One aspect of Arcádia's strategy that we consider quite different from that practiced in the Brazilian market concerns the degree of diversification. While common practice in developed markets like the United States, we've noticed that more concentrated investment strategies are rare in Brazil and often treated as "taboo."

Throughout this text, we present the main reasons behind our strategy of holding between 5 and 15 companies in the portfolio, with holdings ranging from 5 to 25% of the fund's assets.

Concentração permite maior retorno potencial

Our philosophy is based on allocating significant portions of our capital to the theses in which we have the greatest conviction. We differ from most investors when it comes to diversification because we believe that excellent investment opportunities are rare, and our top 10 theses will always have a much higher return potential than our top 50 theses. In a portfolio of 50 stocks, the 50th stock has a worse expected return than the top stock, so adding it to the portfolio will likely reduce the potential gain of the portfolio as a whole.

Therefore, we focus more on the few great investments we find, rather than also investing in opportunities with average potential just for diversification purposes.

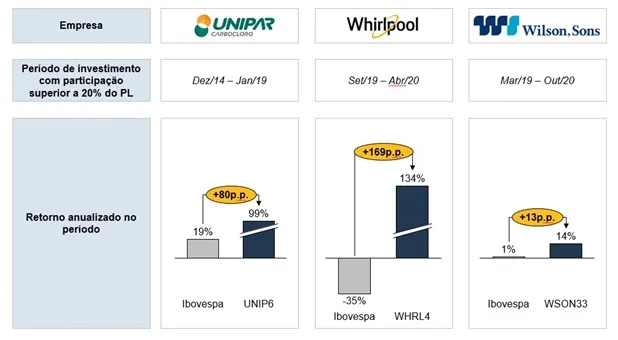

Throughout our history, we've had three investments that surpassed the 20% portfolio threshold. In all of these situations, the returns achieved were significantly higher than the overall market in the respective periods and contributed significantly to Arcádia's historical performance.

Chart 1 – Investments with relevance greater than 20% of PL

“In the field of common stocks, a little bit of a great many can never be more than a poor substitute for a few of the outstanding” – Phil Fisher

The natural question that arises after this explanation is: “Doesn’t this approach create more risk for the portfolio?”

In our view, no. The justifications appear in the topics below.

Foco leva a maior profundidade nas empresas investidas

A more concentrated portfolio requires us to be more careful in our decision-making, understanding the companies and the risks involved in each investment better. Even after detailed analysis, the investment will only have a significant presence in the portfolio when we have a high level of confidence in the thesis.

To achieve this level of confidence, it's necessary to dedicate considerable time to research and monitoring. This level of dedication isn't possible with a highly diversified portfolio, so we prefer to focus on a maximum of 15 investments at a time. Furthermore, between investments and monitoring, each Arcádia analyst covers a maximum of 10 companies.

When concentration is accompanied by a deep level of knowledge of the assets and the discipline and patience to invest only when there is a significant margin of safety, there is a reduction in investment risks.

“Diversification is a protection against ignorance. It makes very little sense for those who know what they are doing” – Warren Buffett

Poucas ações são suficientes para capturar os benefícios da diversificação

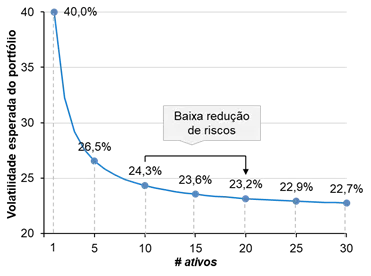

Many seek diversification as a means of reducing portfolio volatility and risk ("not putting all your eggs in one basket"). While this makes intuitive sense, the numbers show that the benefit of volatility reduction decreases dramatically after about 5 companies invested.

The chart below illustrates this concept. It shows the expected volatility of a portfolio according to the number of companies invested, and it's clear that the risk profile of a portfolio with 10, 20, or 30 assets is very similar.

Chart 2 – Decreasing benefits of diversification (portfolio volatility vs. number of assets held)1

If a portfolio of 10 stocks has a similar risk profile to a portfolio of 30, and offers a higher return prospect, it doesn't seem to make sense to invest in the more diversified portfolio.

“The number of securities that should be owned to reduce portfolio risk is not great, as few as ten to fifteen holdings usually sufficiency” – Seth Klarman

Diversificação não protege contra riscos sistêmicos

There are two types of risk to consider when constructing a portfolio: non-systemic and systemic risks.

Non-systemic risk is that which affects specific companies or sectors. Examples include: regulatory changes affecting a particular industry; companies exposed to technological obsolescence; companies with accounting fraud; etc. This is the risk that diversification seeks to protect against, but as we saw in the previous section, a portfolio of 5 to 15 stocks already does a good job of providing such protection.

Systemic risk is risk that affects the market as a whole. For example, an increase in interest rates across the economy reduces stock market prices as a whole, regardless of the company or sector it operates in. In this scenario, portfolio protection is not achieved through diversification, but rather through hedging mechanisms or allocation to other asset classes (e.g., increasing the portfolio's cash position).

The Covid-19 crisis in March 2020 was an example of systemic risk, affecting the market as a whole. During the crisis, all stocks fell together, and diversification did not provide greater protection for investors, precisely during this period when they needed it most. Proof of this is that, during the Covid-19 crisis, Arcádia fell 34%, compared to a drop of up to 47% for the Ibovespa (an index of more than 60 assets) in the same period.

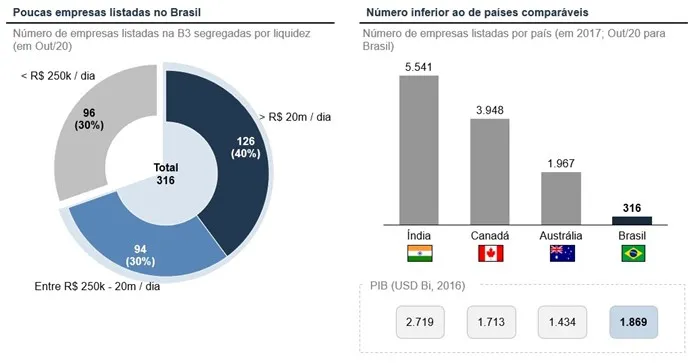

Há poucas empresas listadas no Brasil

The arguments in points 1 to 4 above are valid worldwide. Even on the American stock exchange, with over 5,000 listed companies, this threshold of 5 to 15 investments is sufficient.

In Brazil, the number of listed companies is much smaller. As of October 2020, there are 316 listed companies in Brazil, of which 96 have very low liquidity (less than R$ 250,000 per day), leaving only 220 as legitimate investment opportunities. With a higher liquidity bar (R$ 20 million per day), the remaining number of companies is only 126.

For comparison purposes, countries like India, Canada, and Australia, which have GDPs similar to Brazil's, have 5 to 20 times the number of listed companies. The graphs below illustrate these numbers:

Chart 3 – Number of companies listed in Brazil and comparison with other countries

With only 220 companies with investment potential (122 with the liquidity bar for many investors), we don't think it makes sense to build a highly diversified portfolio. A portfolio of 50 assets is betting that nearly 25% of the companies on the stock exchange are good investments at that moment (good companies at the right price), which we don't think is very likely.

In short, maintaining a portfolio of 5 to 15 companies allows us to focus our bets on the best investments, understand the companies we invest in well, and maintain a comfortable level of diversification.

Our comfort level with this level of diversification is reflected in the size of our personal investments in Arcádia – today, 58% of Arcádia's Equity is our team's capital.

1 Assumptions: (a) standard deviation per asset of 40% (average standard deviation in Brazil); (b) correlation of 30% between assets (historical average of shares); (c) assets held with equal weights