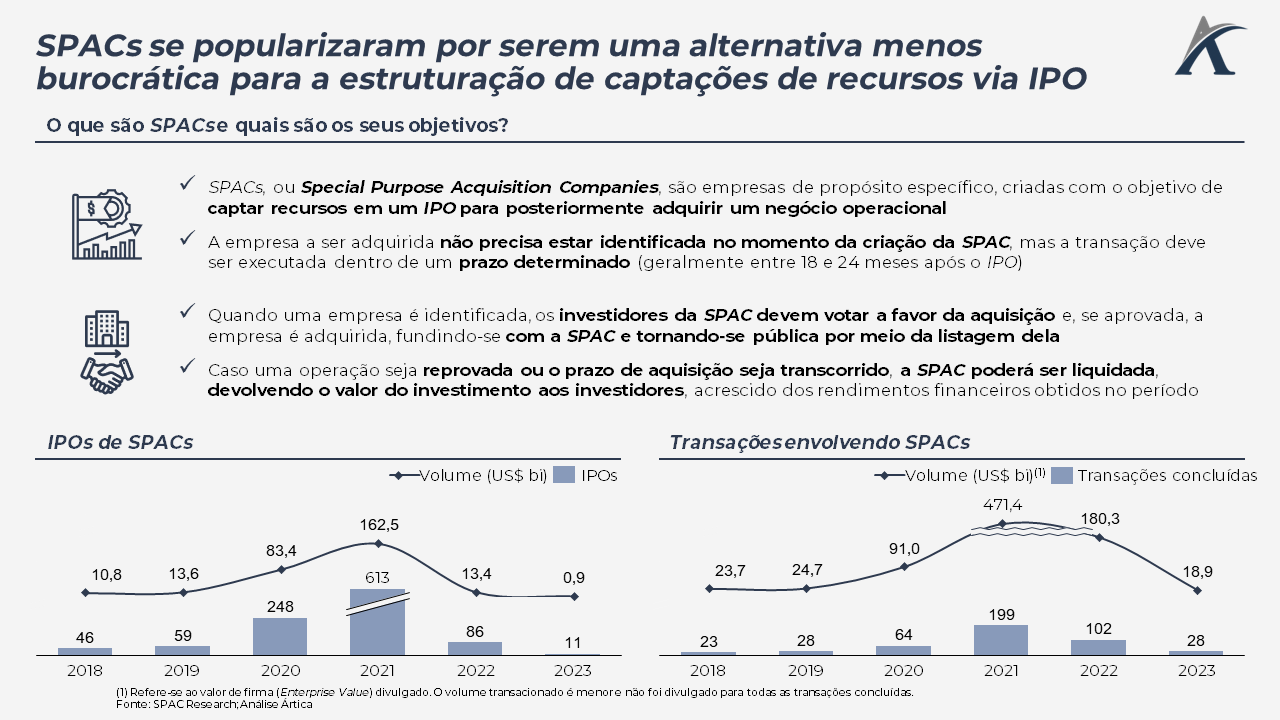

SPACs (Special Purpose Acquisition Companies) have no product, sales or result. Its basic premise is investor confidence in managers, just like an investment fund.

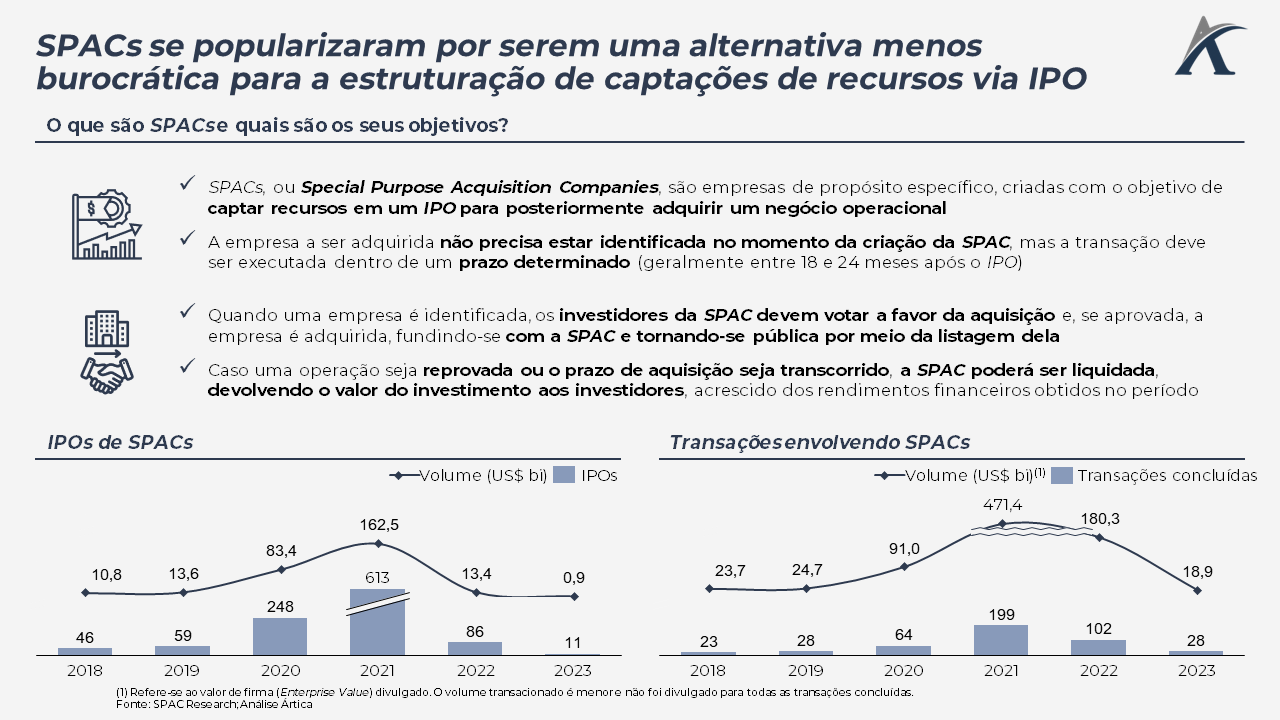

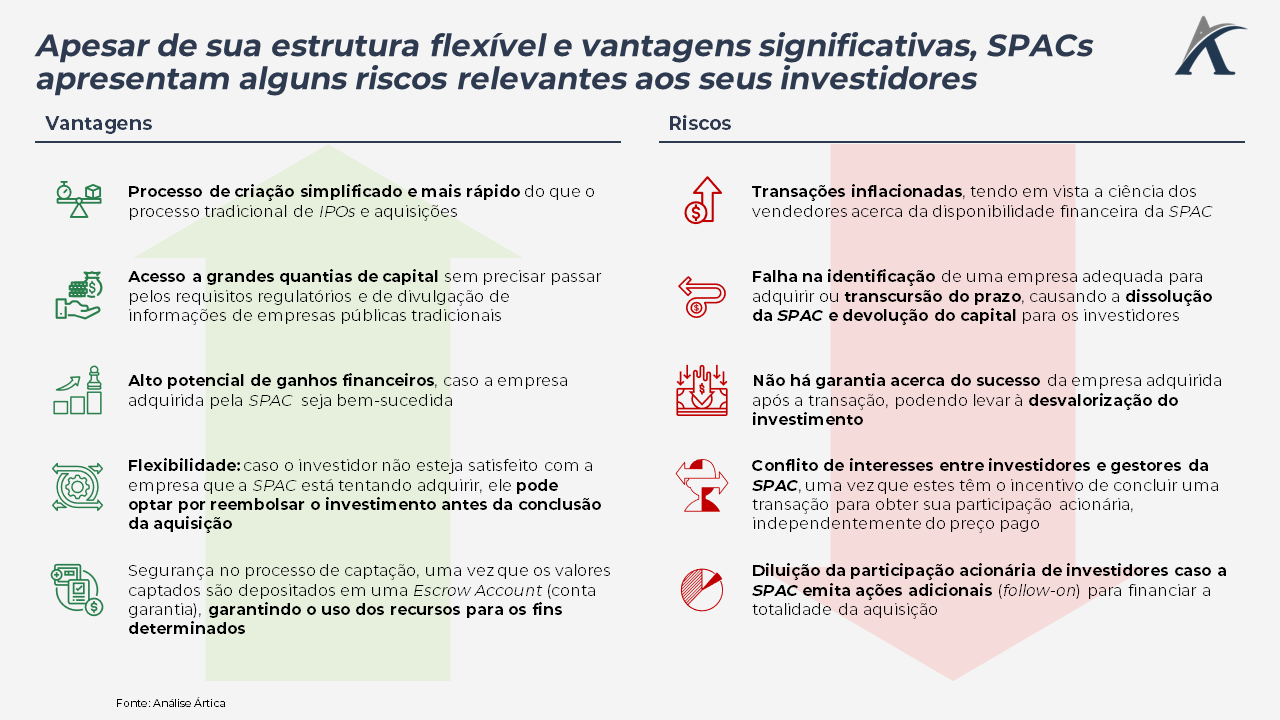

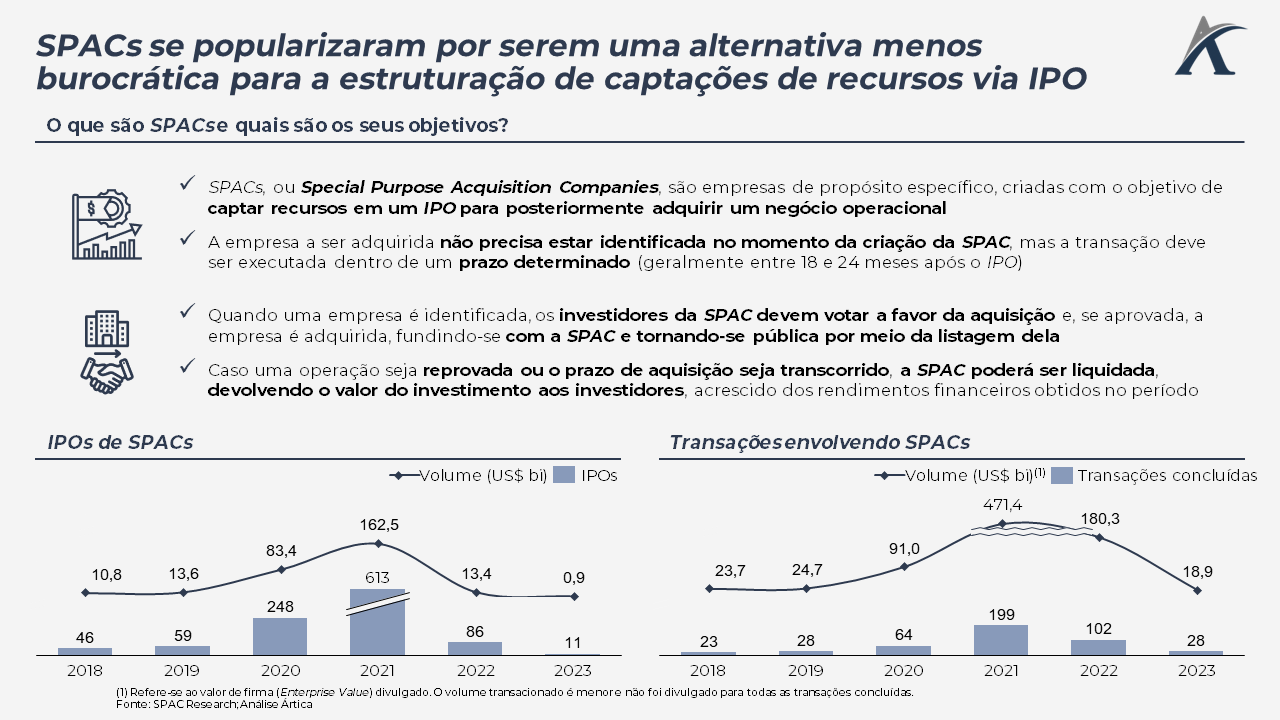

Also called “blank check” IPOs, SPACs are special purpose companies, created with the objective of raising funds for the future acquisition of another company, in operational stage. That is, a SPAC works as an investment vehicle, raising funds through an IPO and making the acquired company public, without it having to go through the traditional IPO process.

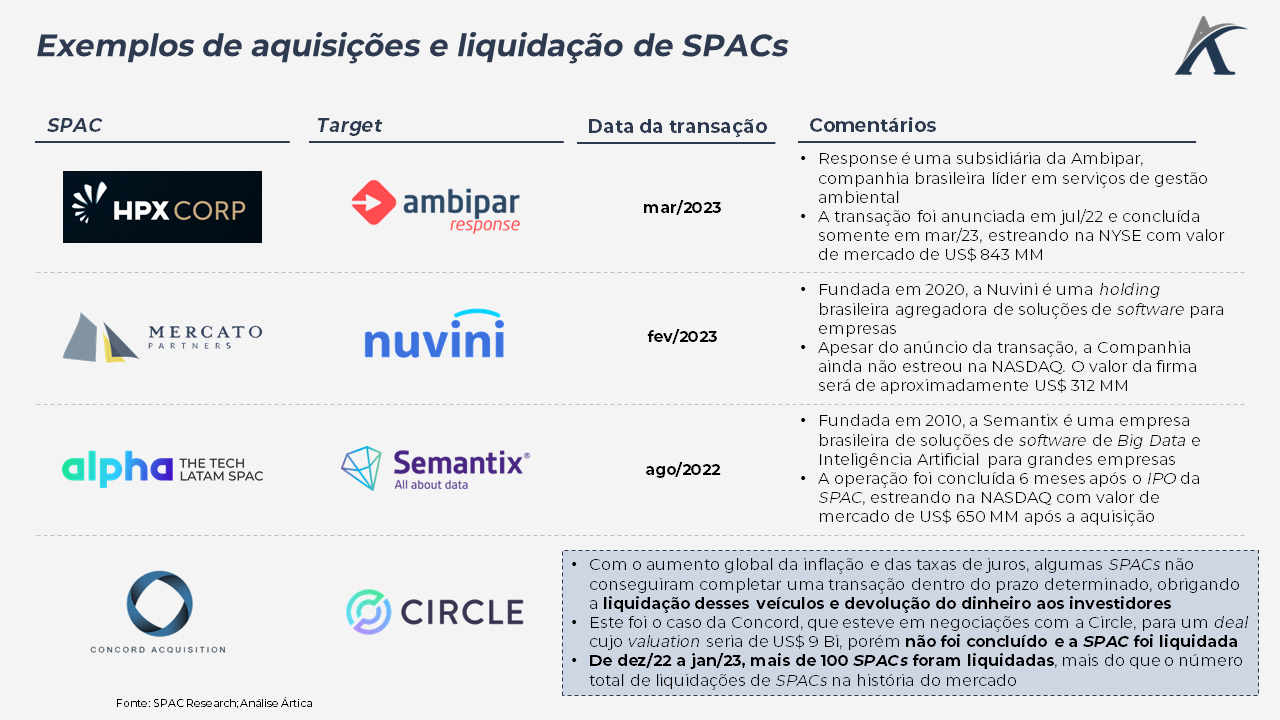

Generally, when creating SPACs, managers already intend to look for companies in specific sectors, with high growth potential and small or medium size. From their IPO, SPACs keep their resources in low-risk financial investments in Guarantee Accounts, and have a period of up to 2 years to acquire a company, having to liquidate the company and return the money to investors in case of failure. , plus income from investments.

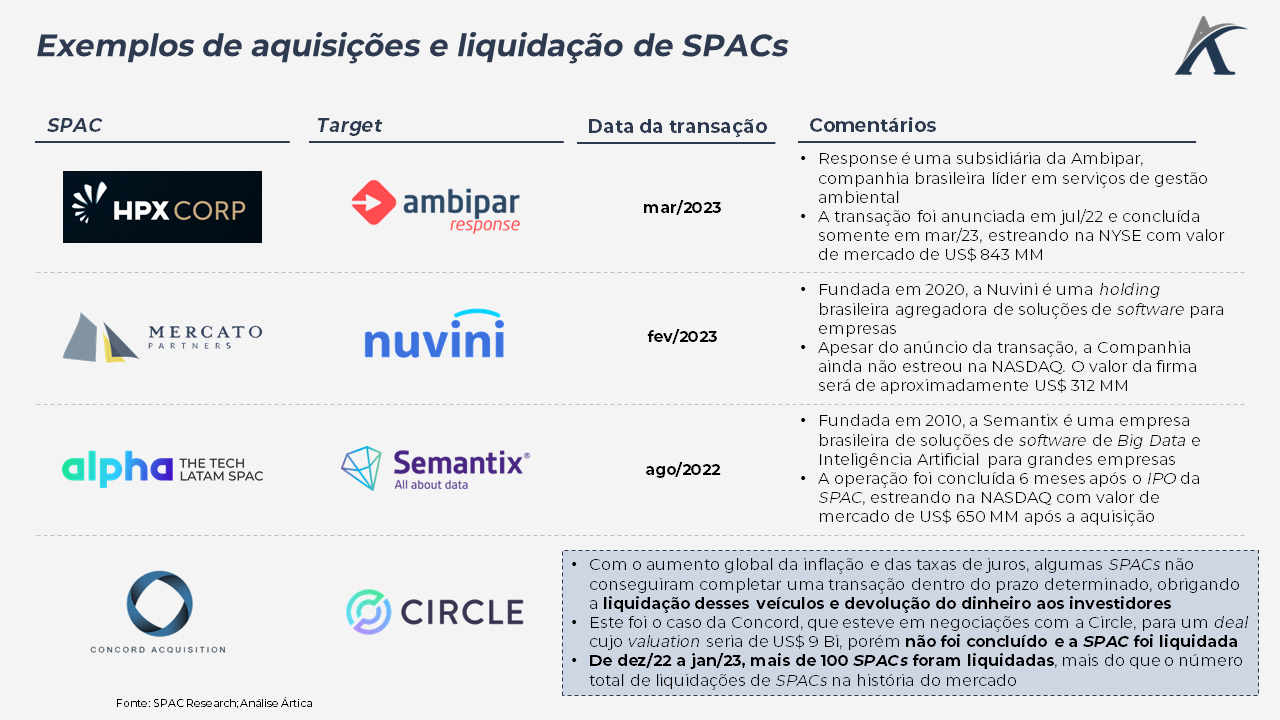

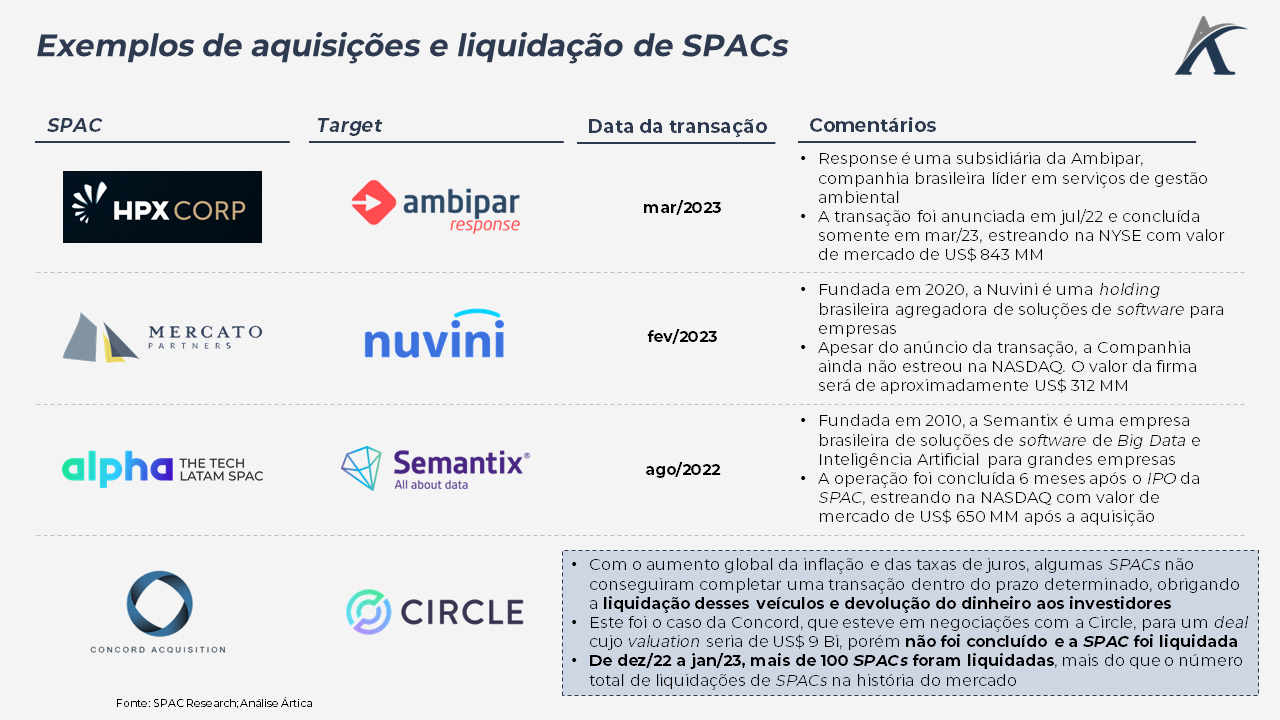

With the recent global rise in interest rates and rising inflation, the pace of emergence of SPACs has slowed, and many SPACs have not even managed to complete a transaction, causing these partnerships to liquidate and return billions of dollars to investors.

Learn more about SPACs in today's pill: