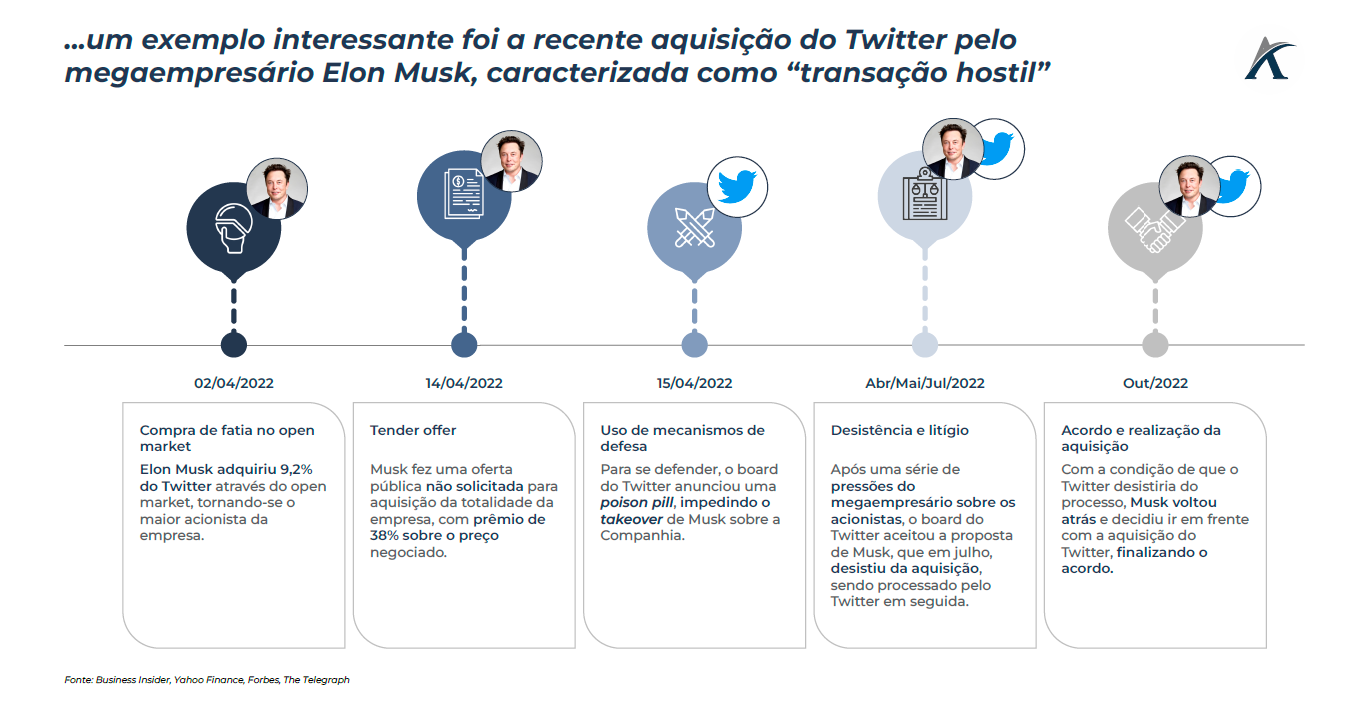

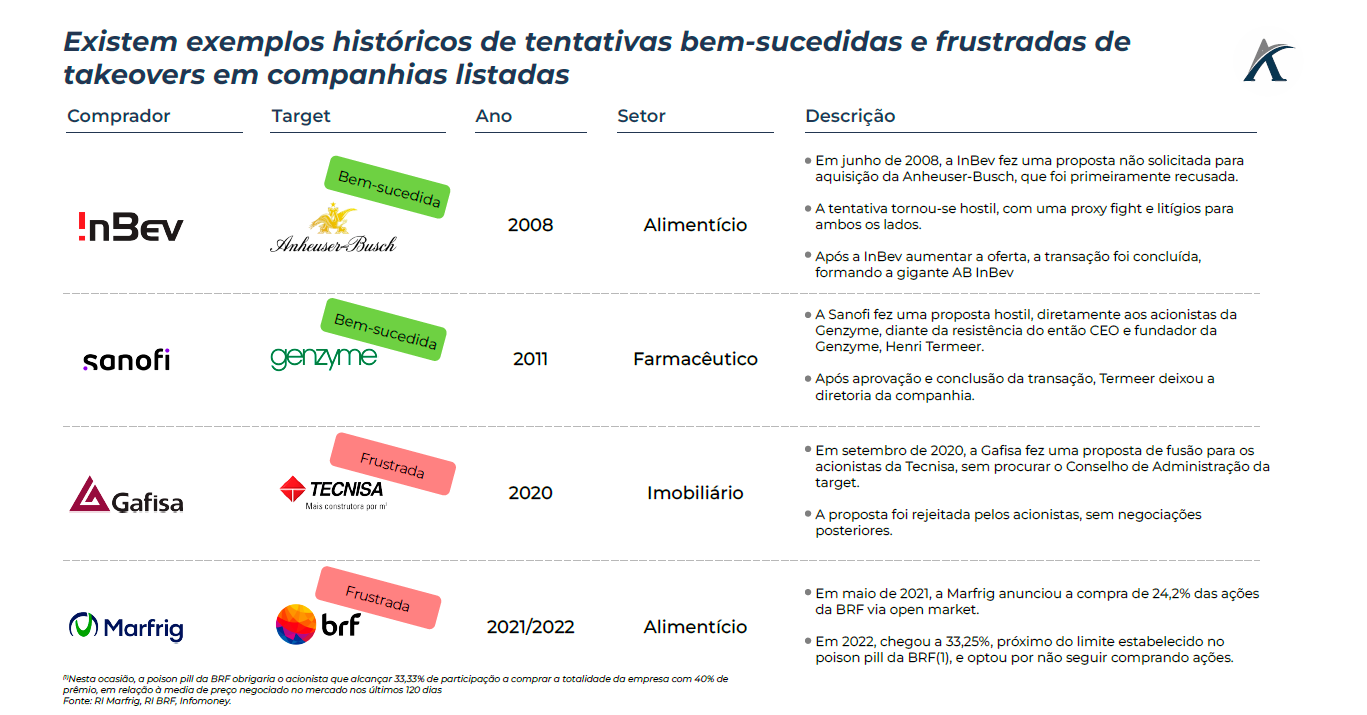

Elon Musk's acquisition of Twitter began in April and was completed only in October 2022. During this period, the company and the entrepreneur fought a series of disputes: silently, Musk became the company's largest shareholder; then announced the full takeover; give up; was processed; and finally reversed its withdrawal and completed the transaction. Processes like this, characterized by an attempt to forcefully acquire control of a publicly traded company, are called hostile transaction or hostile takeover.

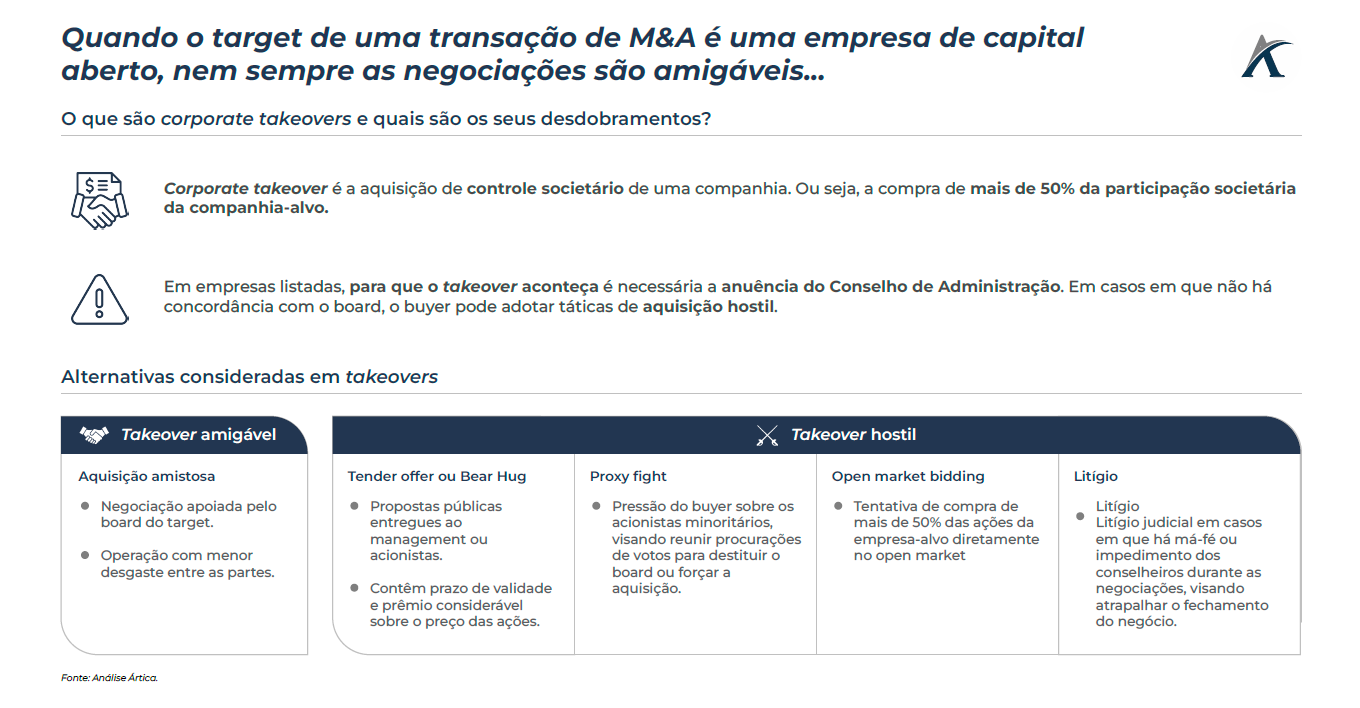

In hostile takeovers, normally, the management and/or Board of Directors of the target company are not interested in selling control of the company, and the buyer starts looking for other ways to complete the transaction to the detriment of a friendly takeover.

Among the most used tactics, the tender offer is a public proposal for the acquisition of the company with a premium on the share price, delivered to shareholders with a defined expiration date. When a public offer is made, minority shareholders who, although they do not have the right to decide, start to pressure and influence Management to accept or reject the proposal.

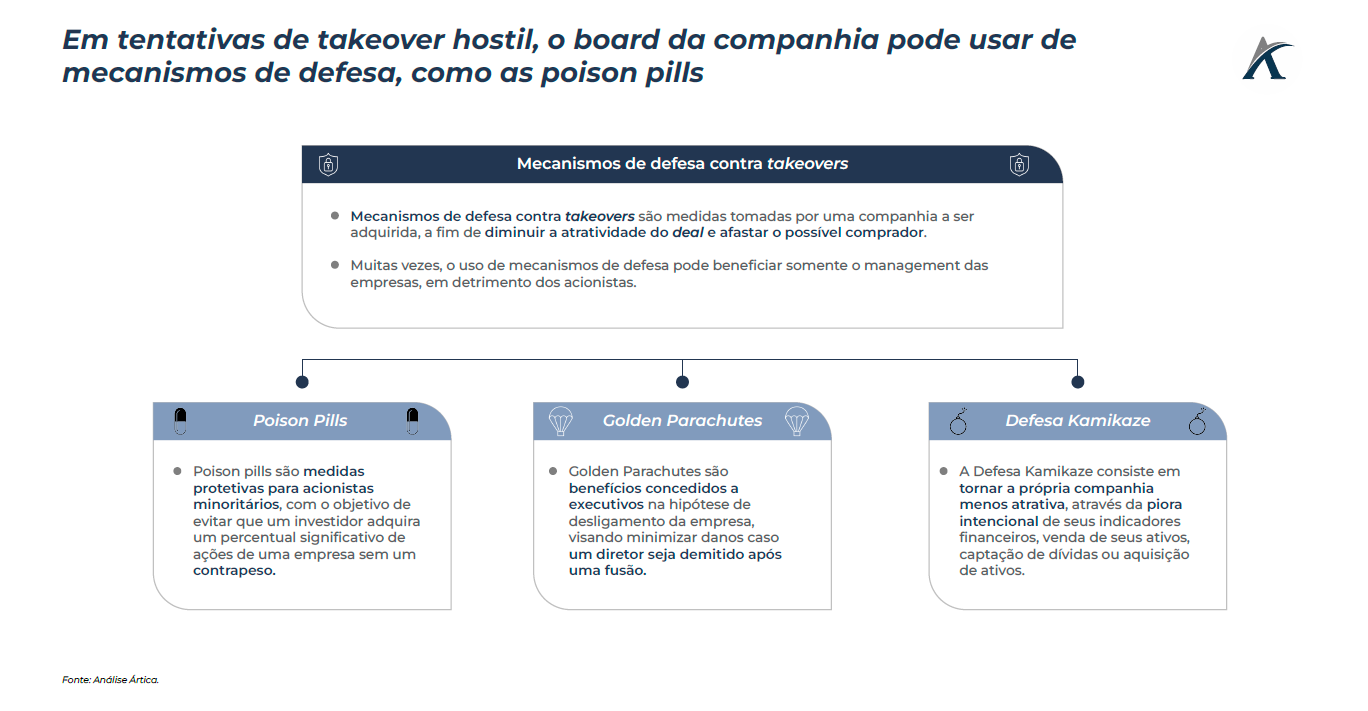

Despite this, in hostile takeover attempts, target companies can use known defense mechanisms. In the process between Twitter and Elon Musk, the company, in order to avoid the acquisition of a portion greater than 15% by the businessman, activated a poison pill, which would give the other shareholders the right to acquire additional shares at a discount in relation to the market price, diluting Musk's stake.