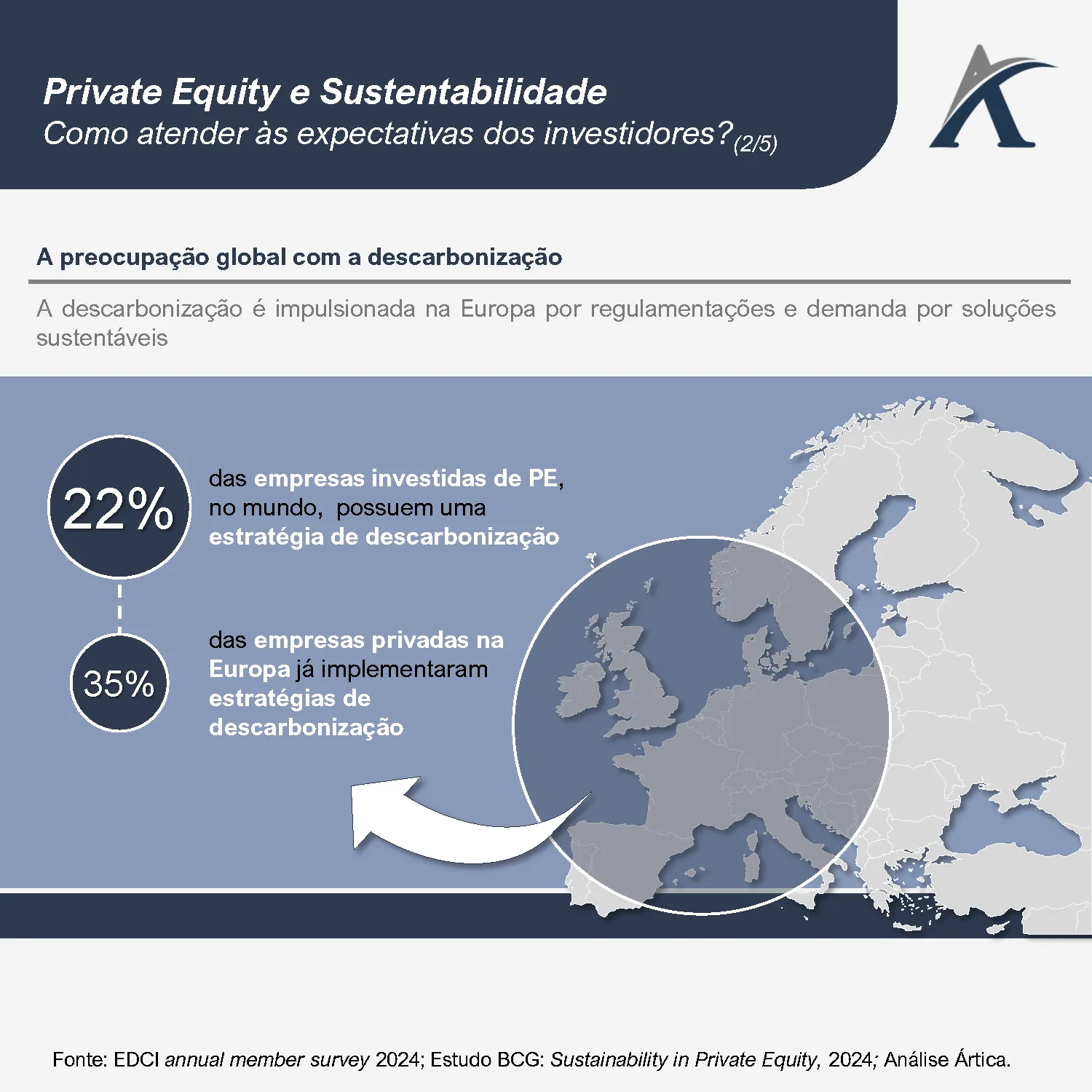

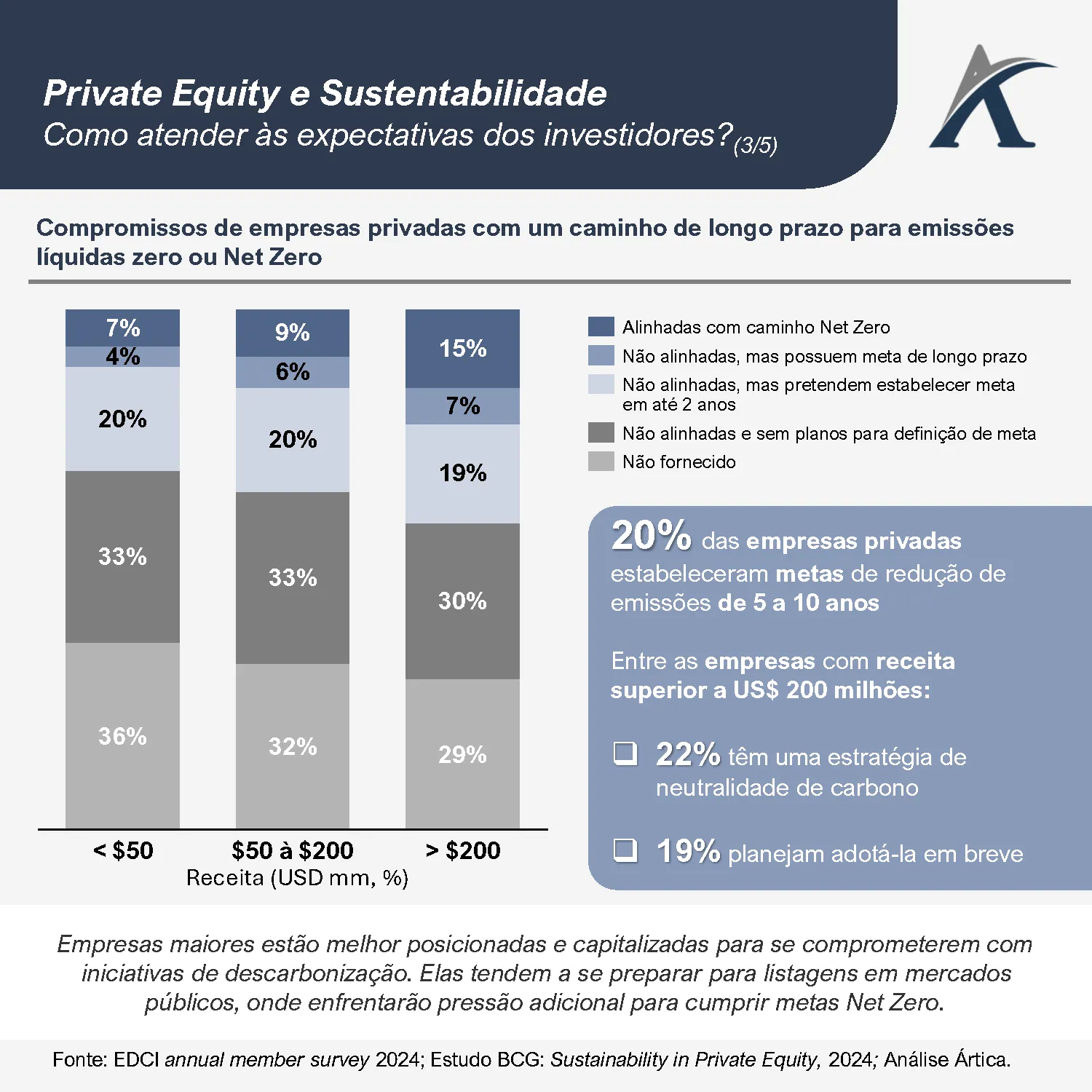

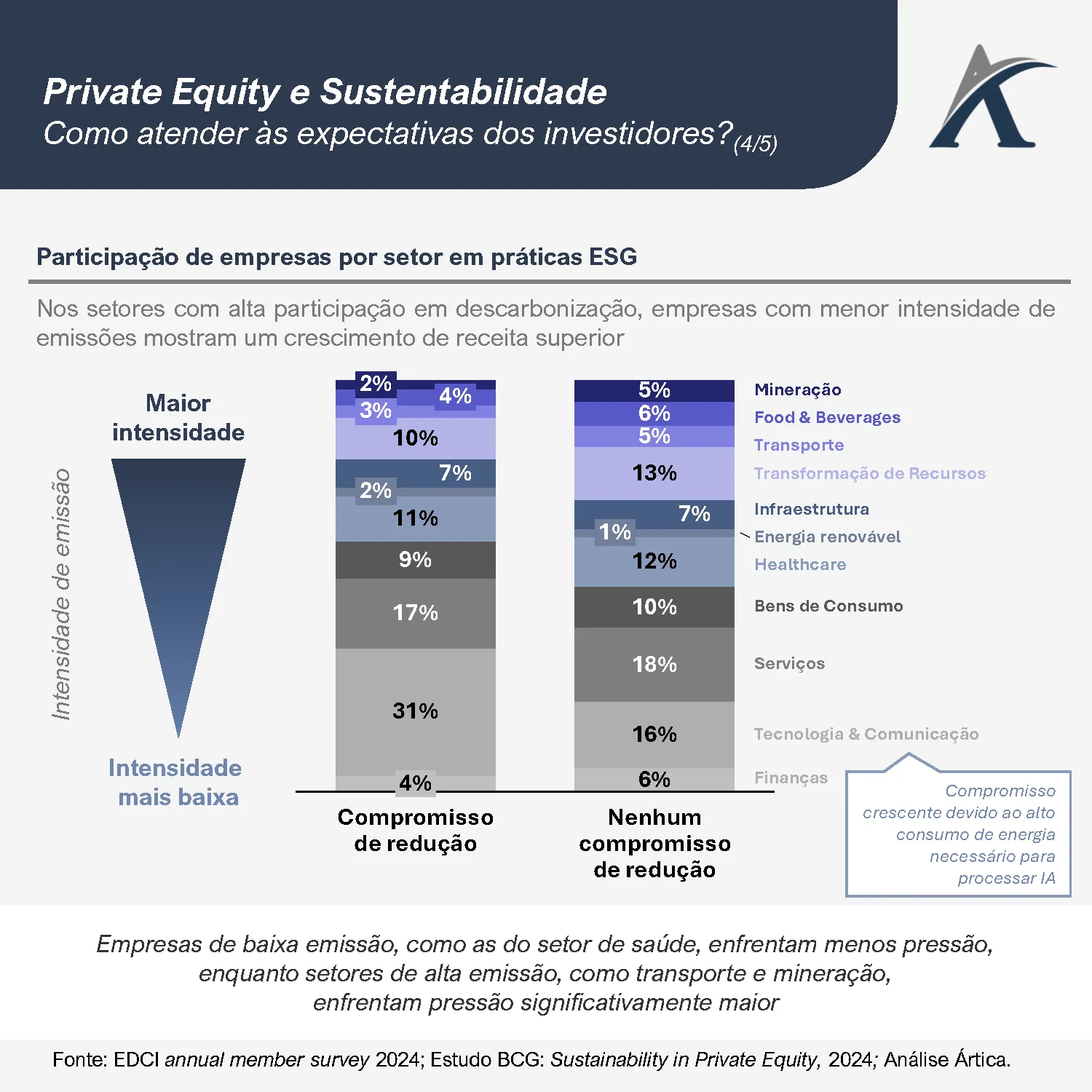

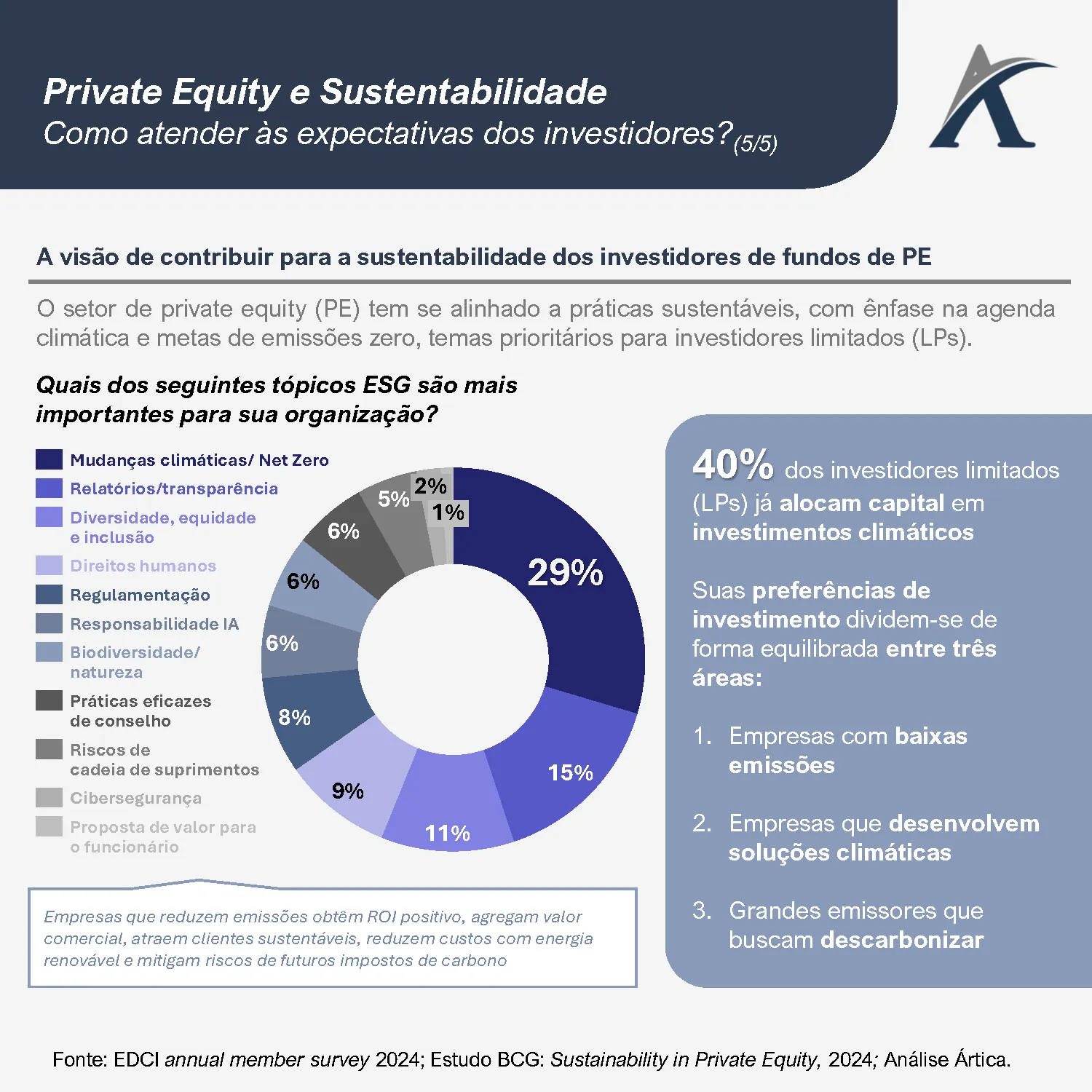

Private equity (PE) firms' commitment to sustainability is evolving rapidly, driven by investor demand and the need to adapt to climate change. PE funds that prioritize decarbonization and ESG (Environmental, Social, and Governance) practices are creating long-term value for both their portfolio companies and the market itself.

By encouraging the transition to more sustainable practices, PE firms help their investees attract conscious clients, reduce energy costs, and minimize future risks, such as exposure to carbon taxes. This approach not only boosts ROI but also positions companies for sustainable growth.

In today's bulletin, we'll present studies that show that companies that have implemented decarbonization strategies have achieved better financial and environmental results, creating a value cycle that benefits all stakeholders.