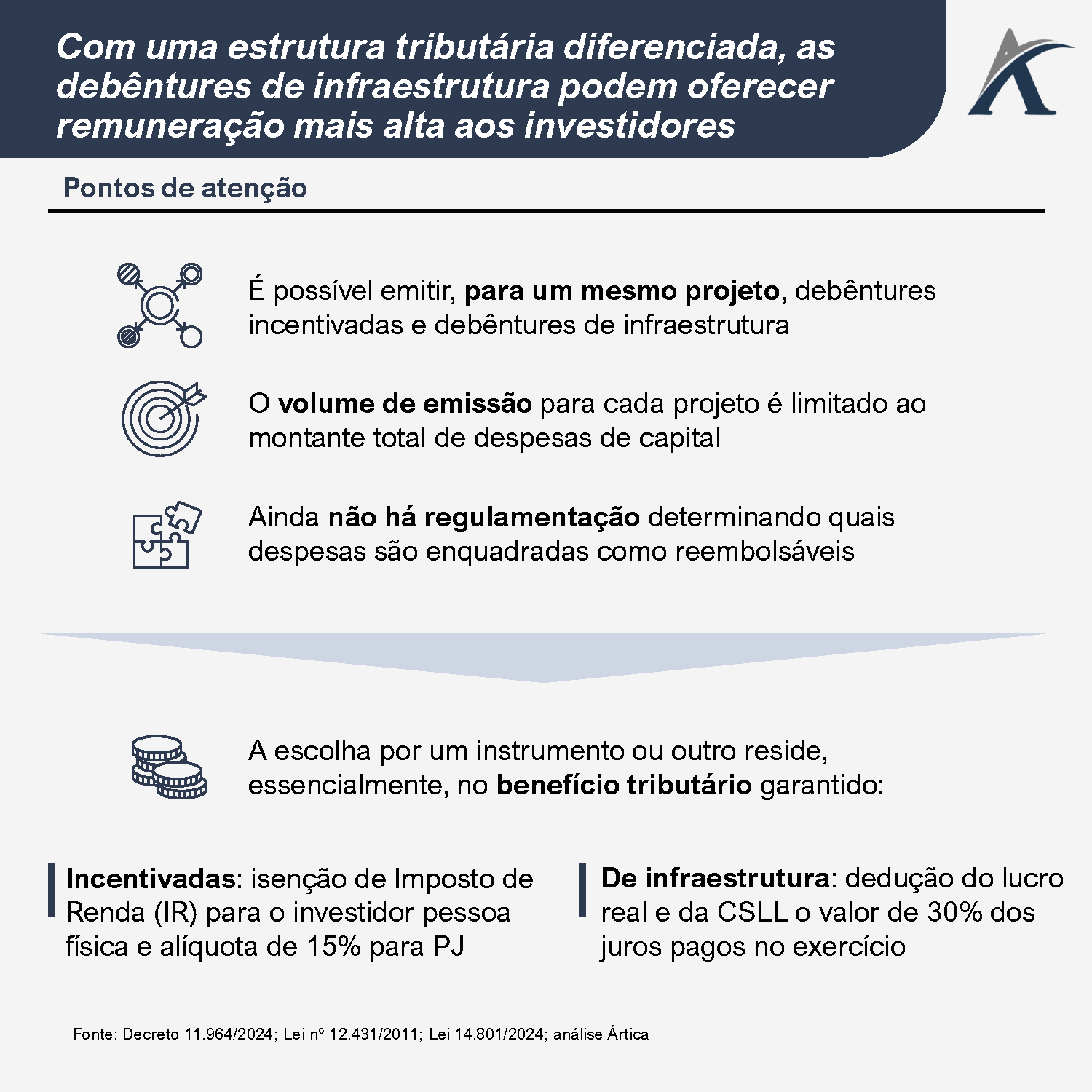

In January of this year, the executive branch sanctioned Law No. 14,801/2024, which introduced a new fundraising instrument into the Brazilian capital market: infrastructure debentures. With the aim of further increasing the financing and research in question, infrastructure debentures are now part of the list of instruments with tax benefits.

This new title, however, should not be confused with incentivized debentures, an instrument already known on the market. The main difference between them lies in the tax treatment, and, unlike incentivized debentures that guarantee exemption from Income Tax for individuals, infrastructure debentures favor issuing companies.

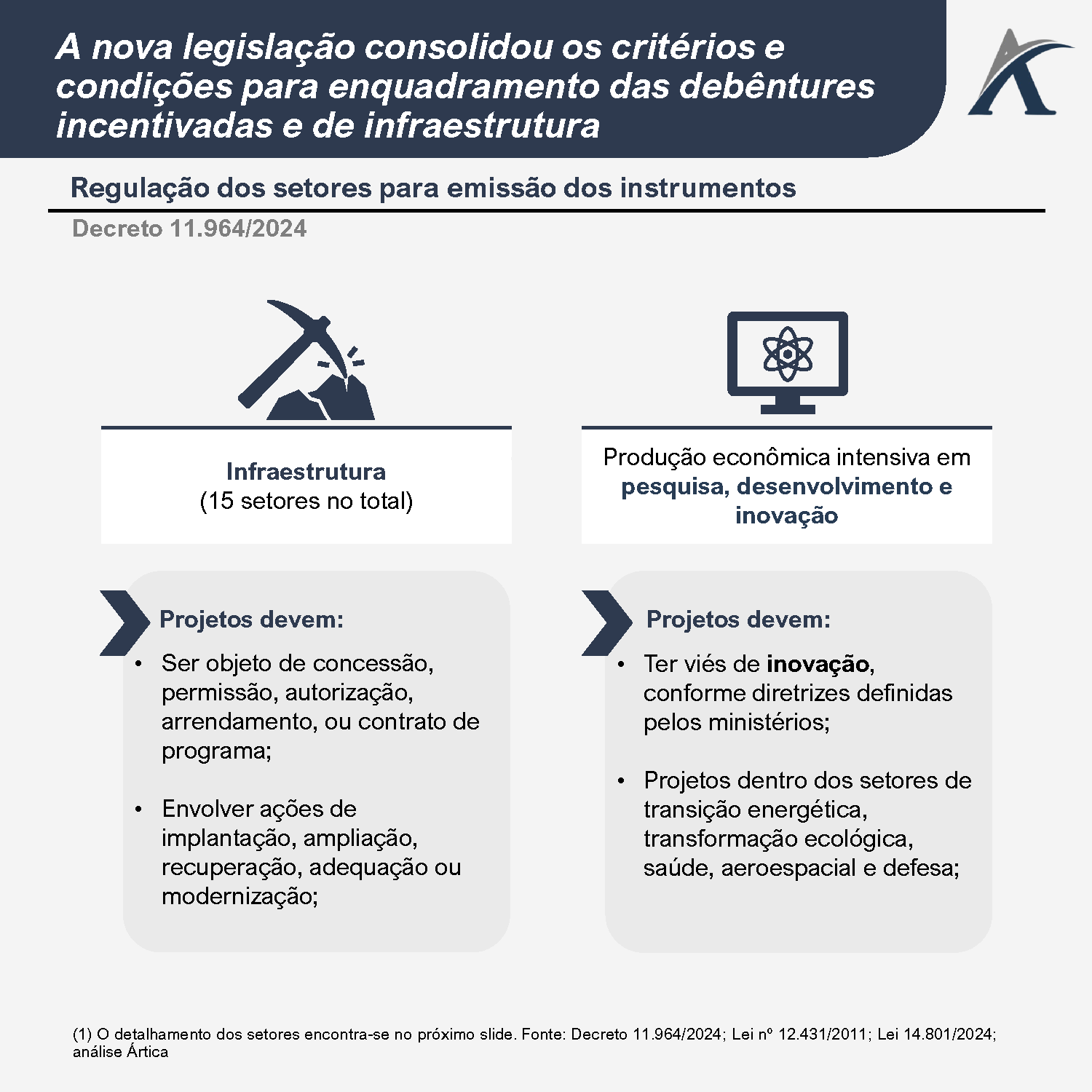

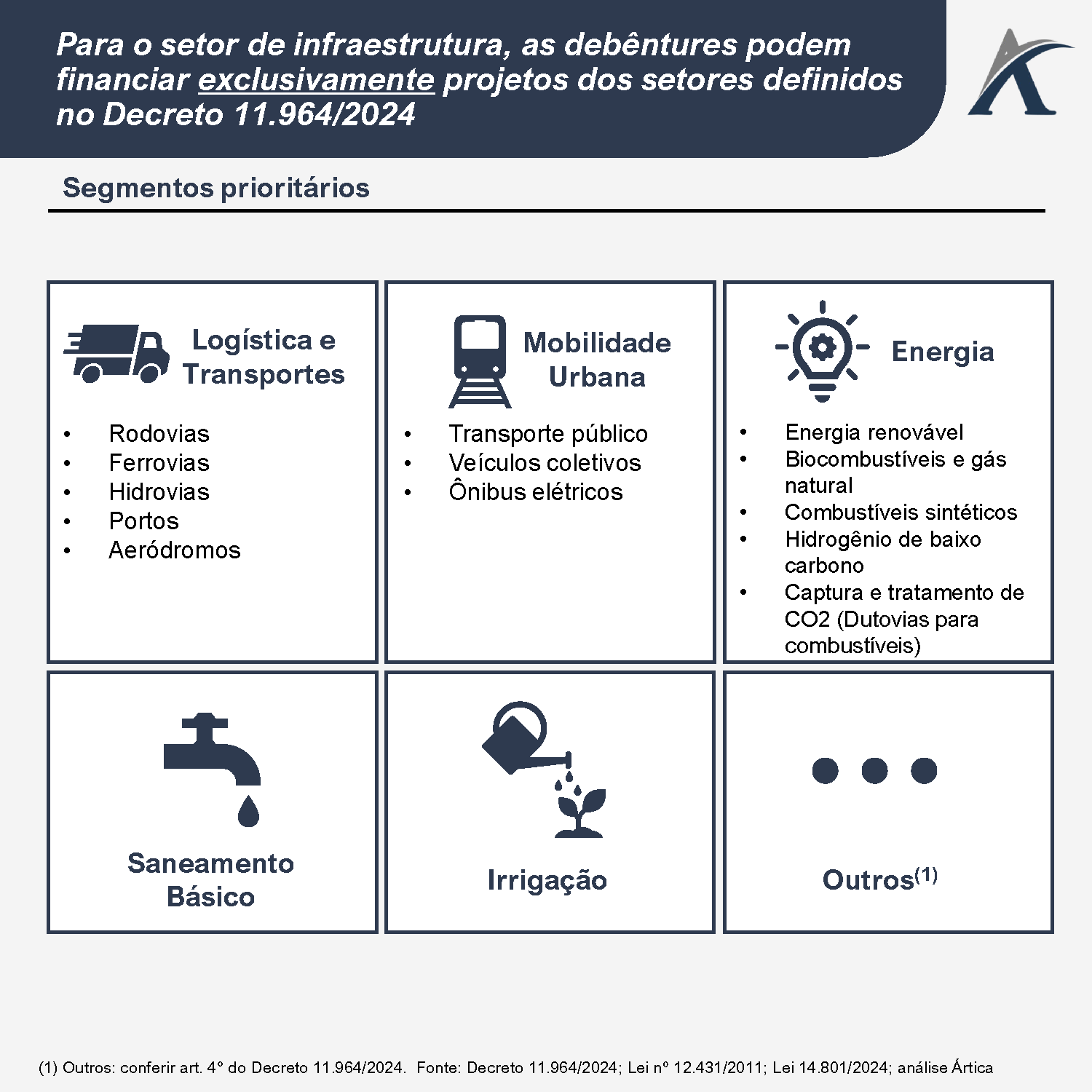

Currently, the regulation of both debentures is regulated by Decree 11,964/2024, which establishes, among other points, the sectors considered as priorities for issuance. The market awaits the issuance of new ordinances to detail the legal discipline of these securities.