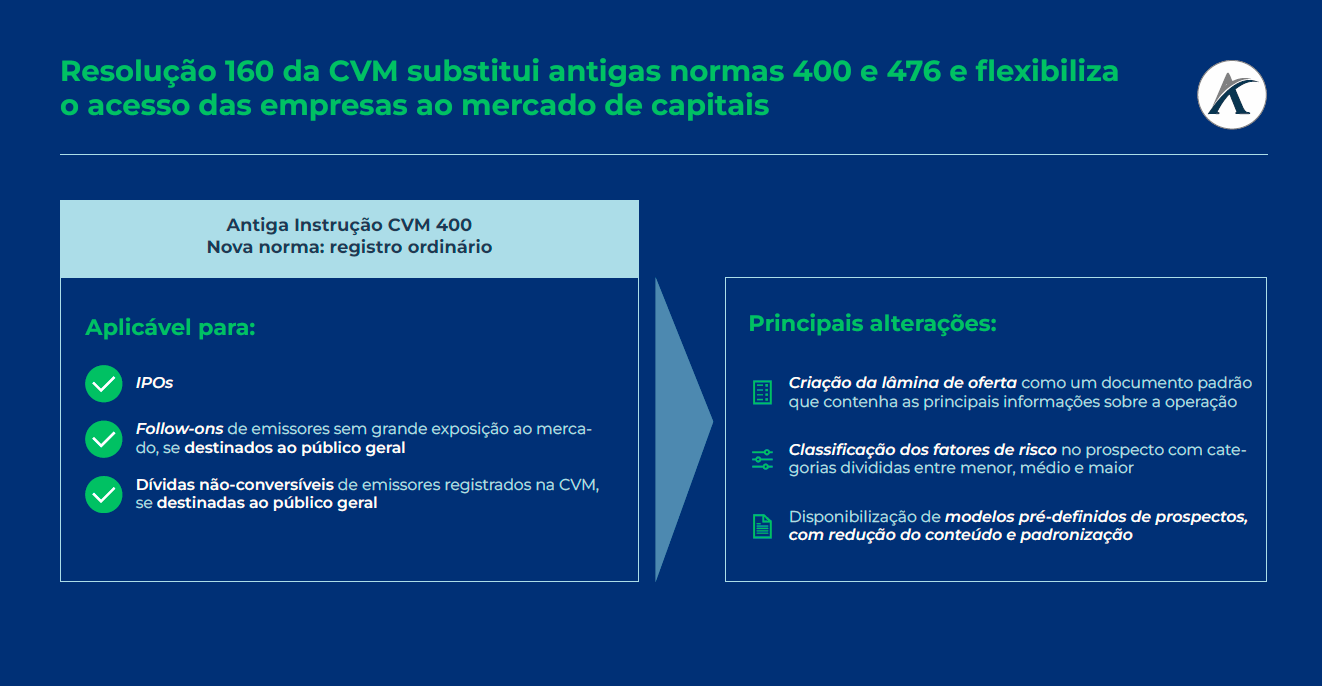

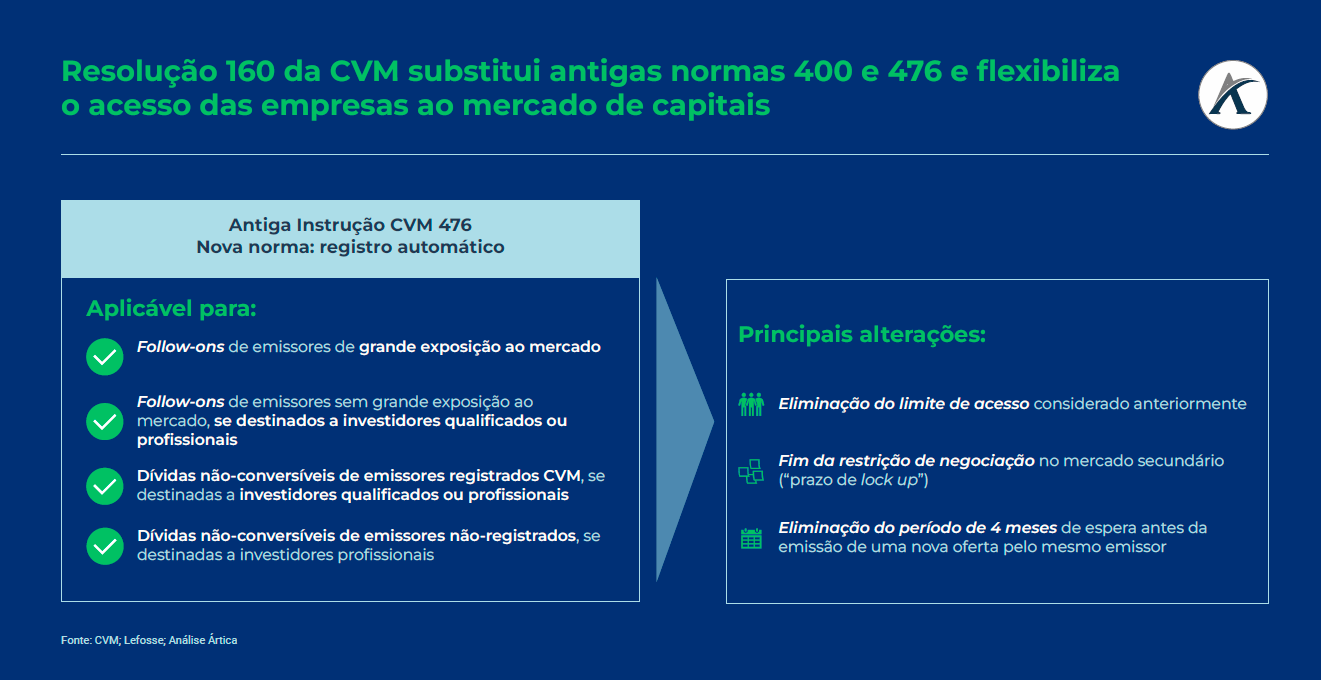

Securities offerings (such as shares, debentures, Certificates of Receivables and others) are governed by the CVM and currently use two main regulations: CVM Instruction 400 (ICVM 400) and CVM Instruction 476 (ICVM 476). The instructions differ from each other mainly in relation to the target audience (general public for ICVM 400 and qualified professionals for ICVM 476) and the type of issuer (registered or unregistered).

The expansion of the investor base in recent years has made clear the need to simplify capital market regulation, facilitating both access to information by investors and issuances by Brazilian companies.

Aiming at this simplification, the CVM held a Public Hearing from March to July 2021 to consult market agents directly involved in the issuances on the positive points and challenges seen in the current resolutions.

As a result, the CVM restructured this process and published, on July 13, 2022, a new rule, called CVM Instruction 160 (ICVM 160), which will come into force on January 2, 2023. The main objectives of this rule are to make the process faster and less costly for companies, as it maintains the rigor of issuance criteria and the protection of investors, especially the general public.

We highlight in the image some of the main changes that attracted attention and generated discussion in the market in the last two weeks, among them, the removal of the limit on access to investors in any issue and the removal of the trading lock on offers issued in the first 90 days after settlement (commonly known as “lock up”).