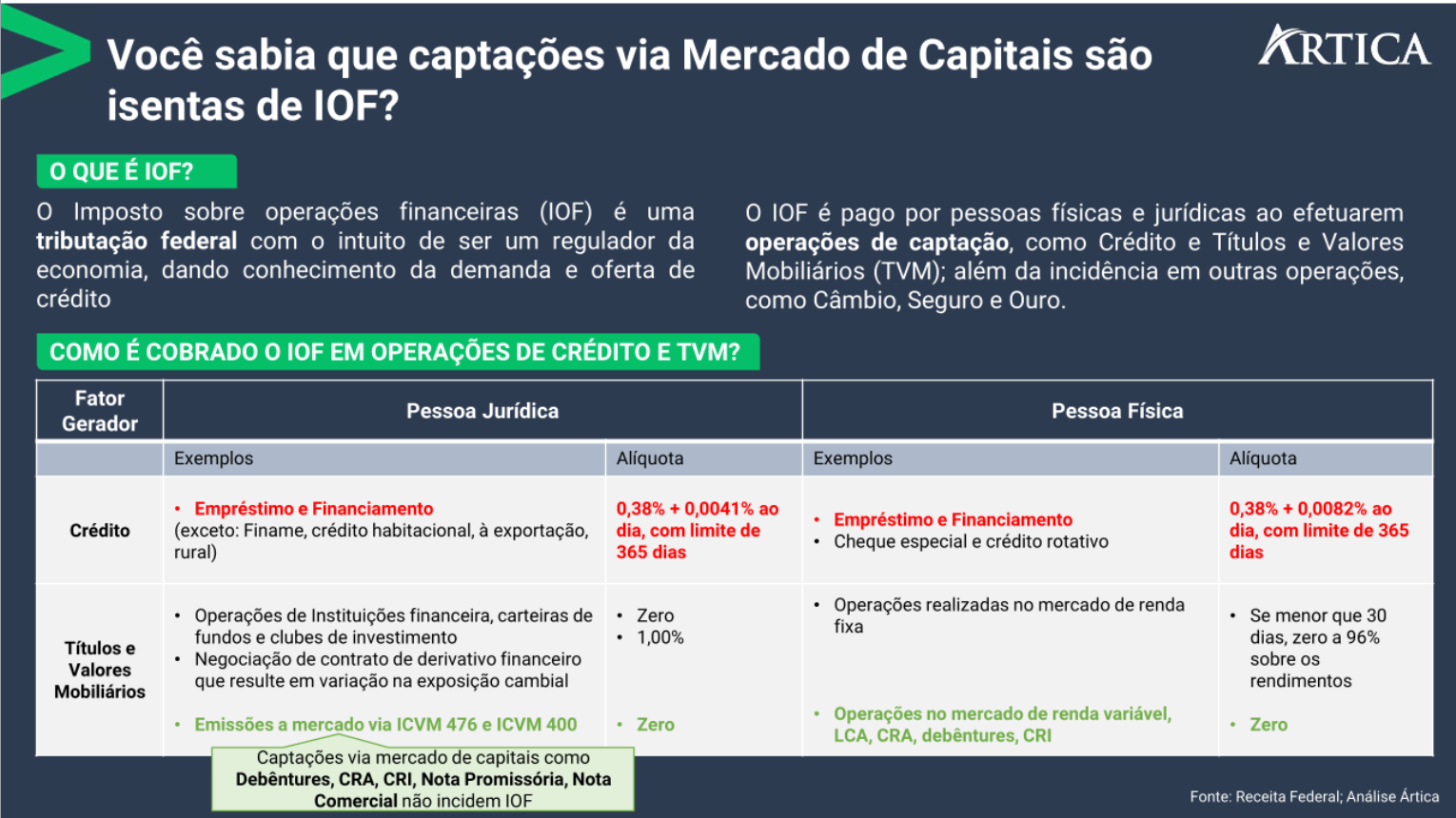

Cost is an important attention factor for companies in the process of raising money via credit. In this sense, understanding the burden of taxes that affect your financing options can bring comparative clarity in decision making. For example, what is the incidence of the Tax on Financial Operations (IOF) among the different options for raising funds for a company?

When a company raises a loan through direct lines of credit with banks, the triggering factor requires the levy of IOF (CCB, Working Capital). Credit lines issued in the Capital Market are exempt from this taxation (Debentures, Promissory and Commercial Notes, CRI, CRA). This tax exemption can be seen as a benefit to the entrepreneur, able to lower the cost of funding in terms of the total cost of the operation (known as “all in”).

On the other hand, the investor can also take advantage of the difference in costs: by making this benefit clear to the entrepreneur in the comparison of costs between the two lines, increasing his own interest (spread) in limits to the comparable cost of the IOF for the traditional lines of the issuer.

It is important for businessmen to pay attention not only to this tax, but also to others and the entire cost structure that composes the “all in” rate before making any credit decision.