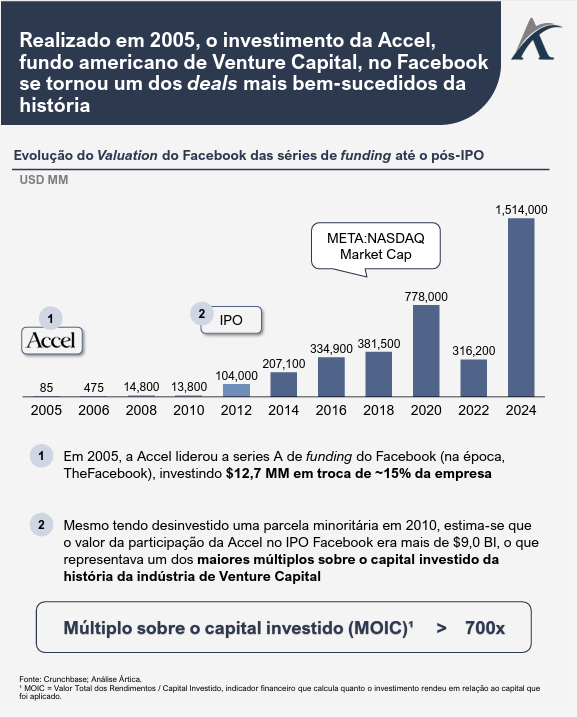

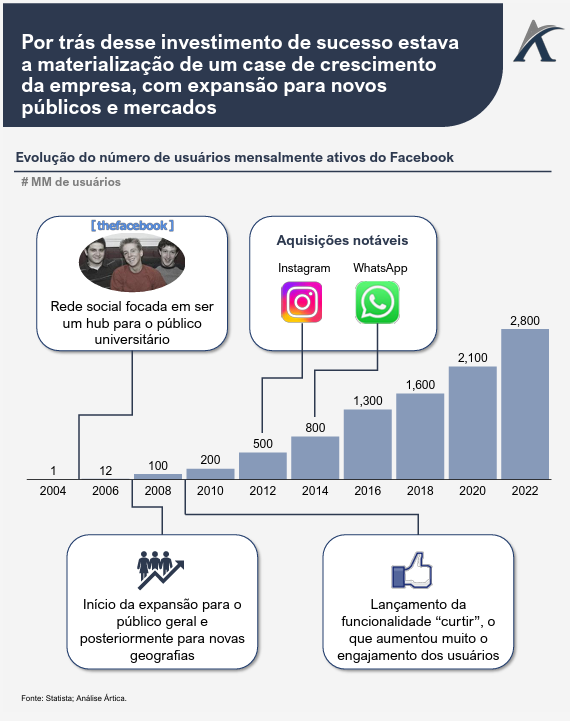

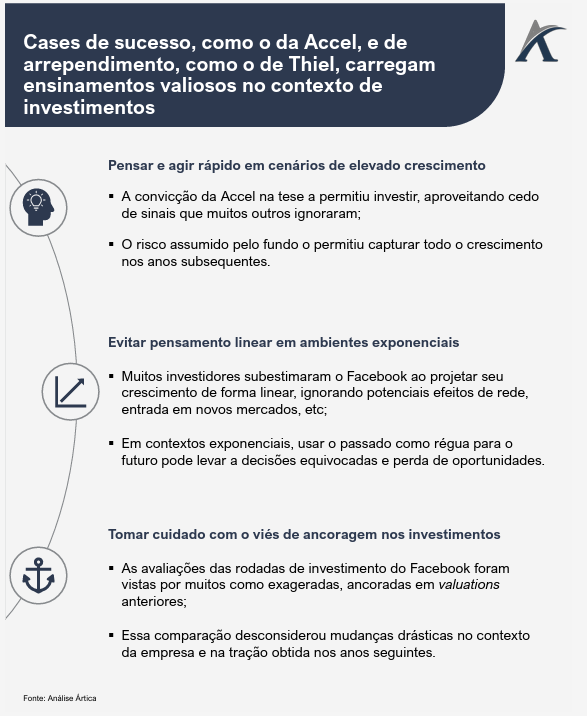

Two notable cases help us understand investment decisions in high-growth contexts. On the one hand, Accel's decision to enter Facebook early, resulting in one of the highest multiples on invested capital in the history of venture capital. On the other, Peter Thiel's regret for not having continued investing in the company, even though he was the first to bet on the thesis.

Both episodes reveal important lessons about cognitive biases and everyday situations that affect even the most experienced investors.

Facebook’s growth has often been projected in a linear fashion, disregarding network effects and geographic expansion. Furthermore, later valuations have been anchored in earlier rounds, ignoring structural changes already underway.

Cases like this show how the ability to review assumptions, perceive signs outside the consensus and act with conviction in the face of subtle changes can be decisive in generating value in investment.