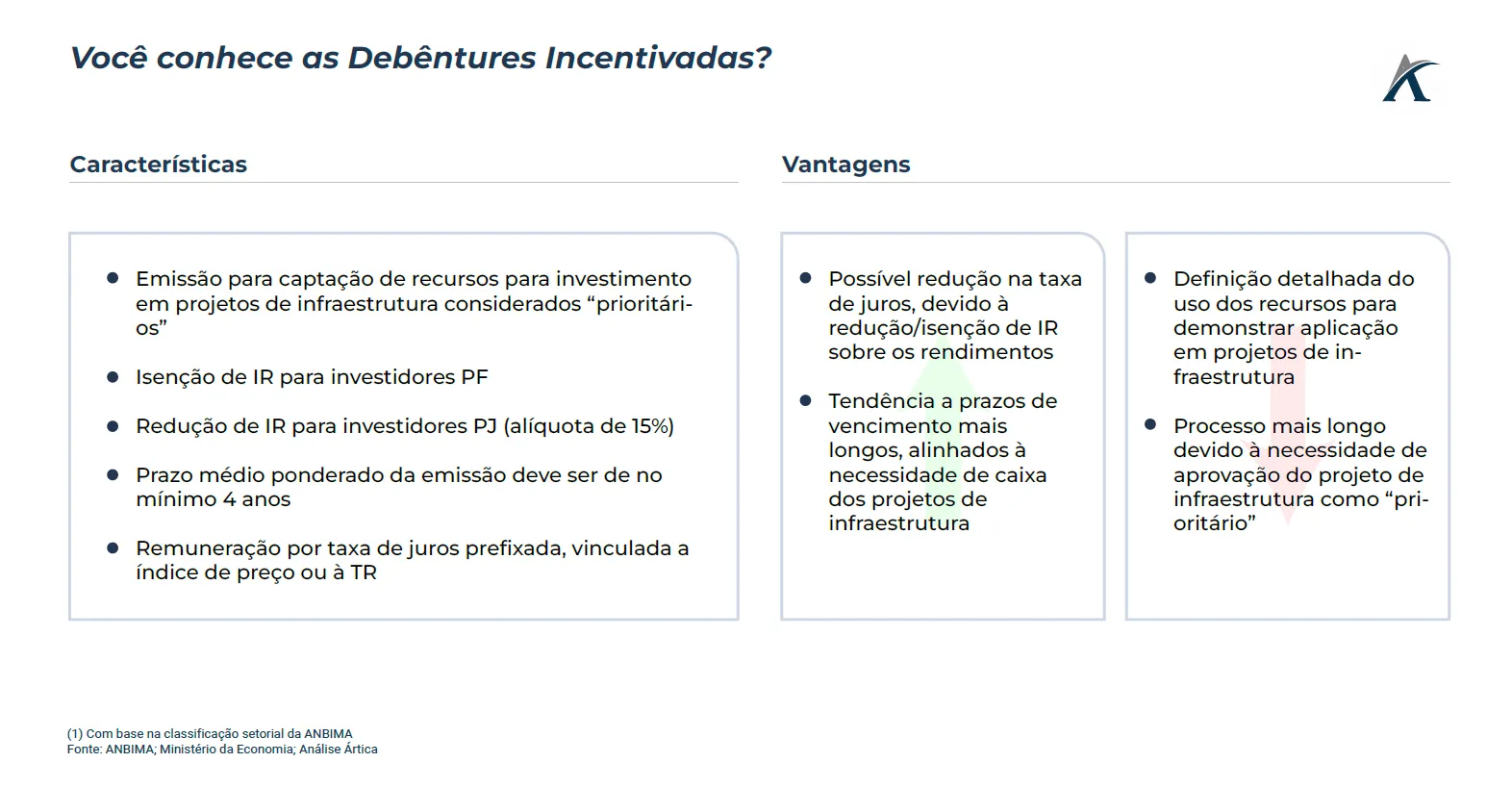

Incentivized debentures are a type of private credit instrument that offers an exemption/reduction in income tax (IR) on investor returns. They were created under Law 12.431/2011, a Brazilian government initiative aimed at fostering infrastructure projects by expanding their access to capital market resources.

The income tax exemption/reduction can facilitate issuing companies' access to investors willing to finance their projects through this type of security. However, to issue an incentivized debenture, the company must define and structure the projects in which it intends to invest and submit them for approval by the Brazilian government. The issuing company must demonstrate a commitment to allocate the proceeds from the debentures to future payments or reimbursement of infrastructure investment expenses.

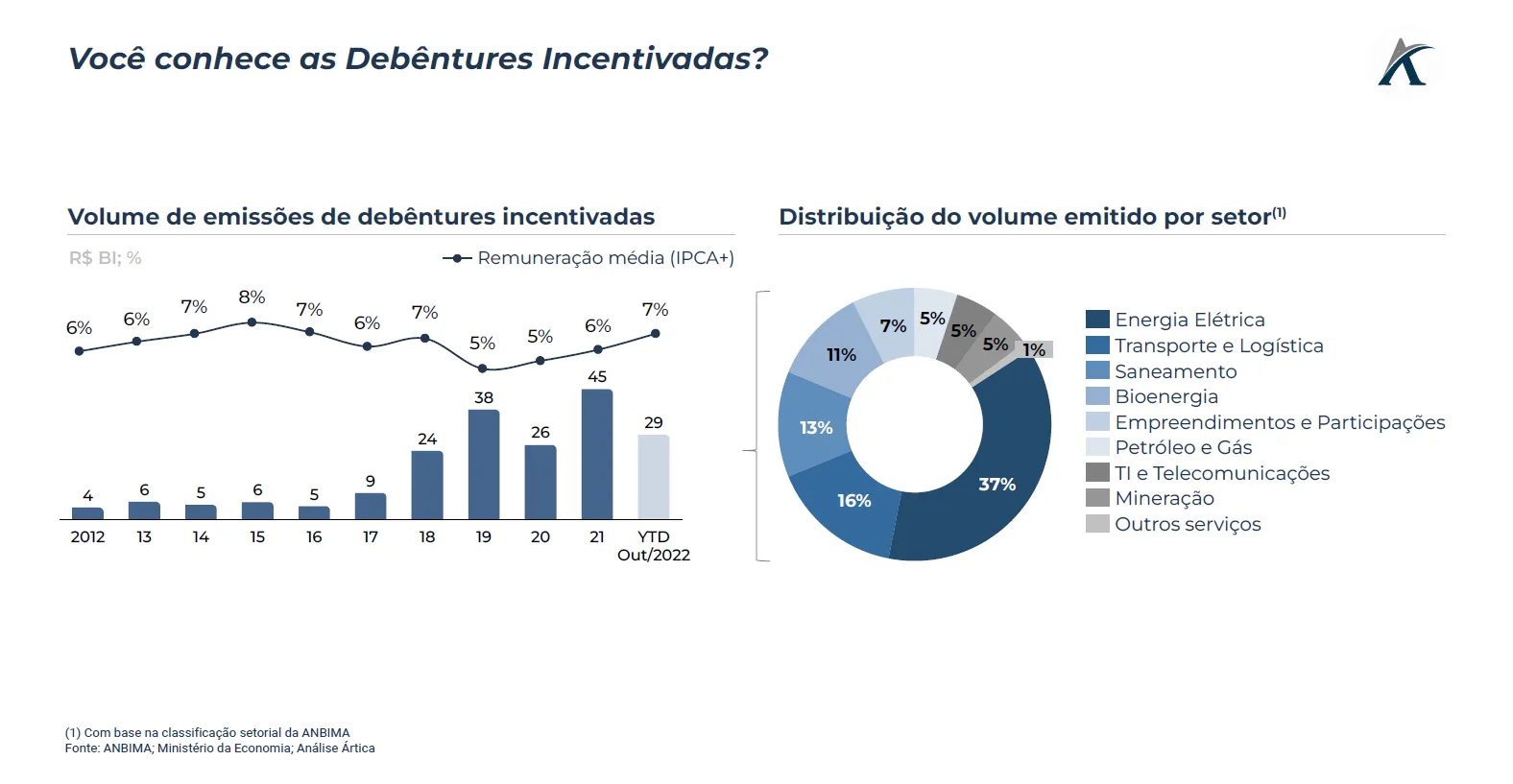

Thanks to their advantages and despite their challenges compared to “common” issuances, incentivized debentures have been gaining ground in recent years, demonstrating the importance of the capital market for the promotion and development of Brazilian infrastructure.