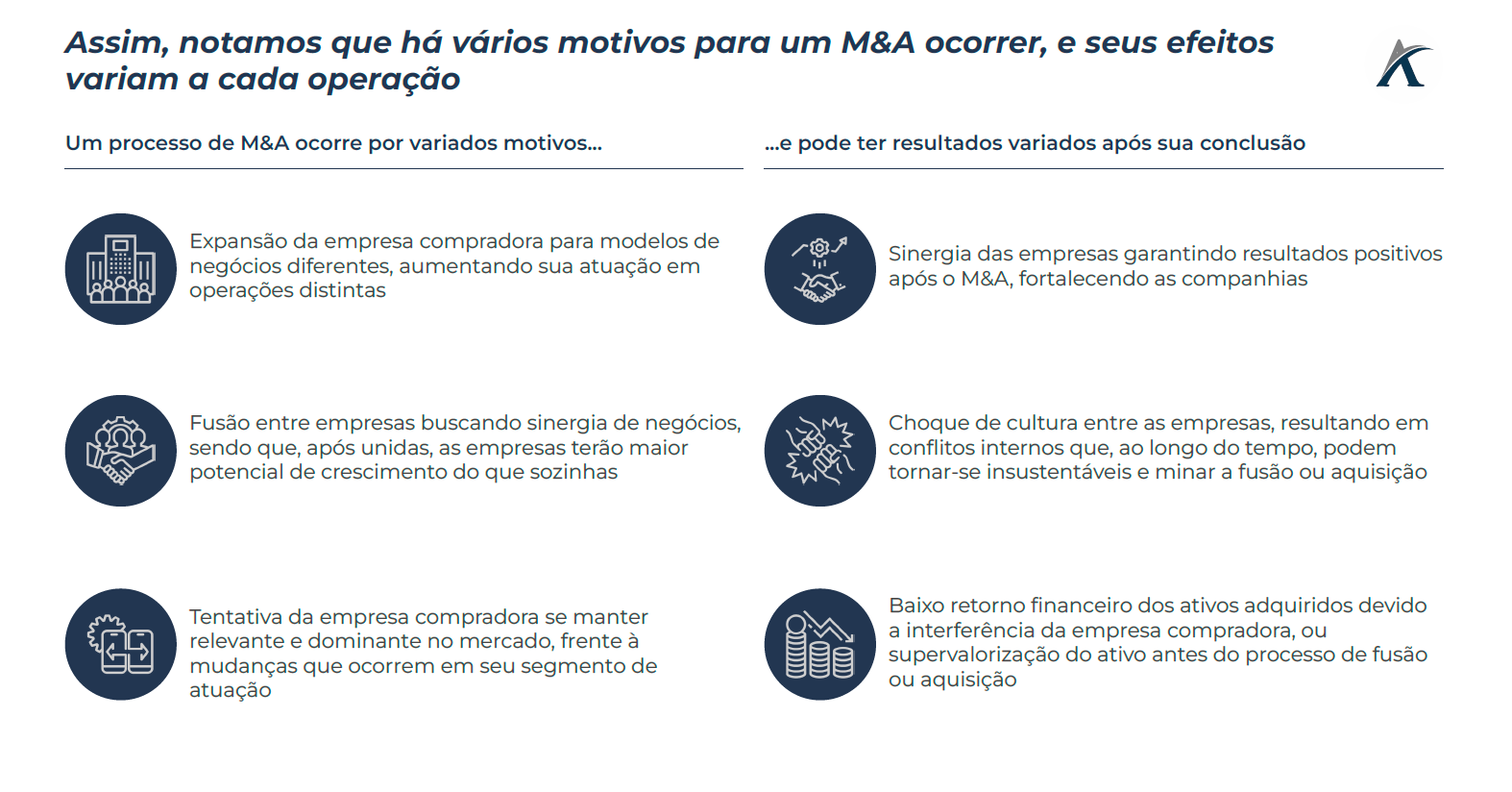

We are used to reading about company mergers and acquisitions on specialized economics and business websites. However, in TV series, available on the most varied streaming services, we can observe several cases of M&A and other market movements involved in the main plot, showing their effects on fictional companies. In these examples, you can see some of the reasons that lead to a merger or acquisition of one company by another. In The Office, the paper trader and company central to the plot, Dunder Mifflin, declared bankruptcy in 2009 (season 6). With serious management problems and loss-making branches, the company had part of its operation acquired by Saber, printer manufacturers, which sought to expand its paper distribution and consolidate synergy with its main activity. Thus, Saber took advantage of the economic fragility of the paper trader to acquire profitable assets for its operation (and allowing the Scranton branch to maintain its operations fully). In the series, we can also see the effects that occur after a merger is carried out. In Mad Men, New York-based advertising agency Sterling Cooper and British advertising agency Putnam, Powell, and Lowe merged in 1962. The effects of the merger are seen in the third season, with layoffs occurring and a strong cultural conflict between companies, especially due to the regional differences faced. Finally, we can also see cases in which, after an acquisition, the purchasing company promotes changes in the acquired company that affect its operations that previously generated good results. In Succession, the conglomerate Waystar Royco acquires, in the 1st season, the digital media company Vaulter, in an attempt to keep up to date with changes in the media segment. However, Waystar promotes significant changes in the acquired company, reducing the startup's operating segments and dismissing producers, affecting the acquired company's operations.